Can I Consolidate My Debt Before Applying For A Mortgage?

Buying a home is a significant and expensive decision for any borrower, and making yourself as attractive as possible to mortgage lenders is crucial. If you have multiple outstanding debts, you might find it more manageable to combine these debts into one loan. But can you do this before applying for a mortgage?

In short, yes, you can.

Consolidating your debt before making your mortgage application shouldn't affect your eligibility. In fact, having a debt management plan might even increase your chances of being accepted.

What is debt consolidation?

When you consolidate your loans, you're taking all of your existing debts and combining them into a single monthly payment. This is known as a debt consolidation loan.

A debt consolidation loan lets you pay off your current debt in a more straightforward and manageable way. As you won't be making multiple payments every month, your debt is much easier to keep track of. You'll only have a single interest rate to be aware of, and you'll no longer have to keep tabs on multiple outgoings every month.

For this reason, debt consolidation is highly attractive and it can help make mortgage repayments more manageable if buying a home is your end goal.

What kinds of debt can be consolidated?

Debts commonly consolidated include:

- Credit card debt

- Personal loans

- Retail cards

- Payday loans

- Student loans

- Utility bills

- Mobile phone bills and more

How does debt consolidation work?

You apply for a debt consolidation loan through a lender, the same as a personal loan. The lender will look at your credit history and income to determine what kind of loan deals they'll offer you.

Should I consolidate my debt before applying for a mortgage?

Despite debt consolidation having a 'risky' reputation, there's no reason why a lender would look at this loan unfavourably. As long as you're consistently meeting your repayments in a timely fashion, consolidating your debt shouldn't have any effect on your eligibility for a mortgage.

If you've found an appropriate debt consolidation loan that suitably meets your needs and you make your payments regularly, it can improve your credit report, therefore improving your chances of being accepted for a mortgage.

It could also boost your mortgage application by helping you pay off your debts faster. As a general rule, debt settlement helps to improve your eligibility for a mortgage. You should always try to diminish your debt as much as possible before making your application.

The only time a debt consolidation loan will negatively impact your chances is if you're failing to make repayments. That's why, if you choose this product, you must select the right deal for you. You should not under any circumstances choose a debt consolidation loan you might struggle to pay for, as the consequences for missed payments can be very harsh, expensive, and have a long term impact on your credit score and future mortgage applications.

How do I determine if my level of debt is acceptable when applying to a mortgage lender?

It's hard to say precisely how much debt is acceptable when applying for a mortgage; each lender will have different limits and criteria.

However, a couple of reliable ways to understand how eligible you might be for a mortgage is by looking at your debt to income-ratio and your credit score. Below we've outlined both in more detail to help you effectively consolidate debt into a mortgage.

Debt to income ratio

An excellent place to start is to total up your debts against your income. This will give you the percentage of your income that is currently going towards your debts. The lower the number, the better your chances of being accepted by a mortgage lender.

Your credit history

Having a good credit history can significantly affect what mortgage deals you're offered. Lenders won't just look at your current situation but at how you've handled debts previously. If you've kept up with repayments and paid in full in the past, this is a big tick on your record.

Creditors will also consider the types of loans you've been taking out. If there are many large, non-essential purchases on your record, it may count against you. However, if your loans are frequently essential (such as for emergency repairs), lenders tend to be more understanding.

Remember, your credit score is something that you can build and improve over time. You'll want to take some time to get it in the best shape possible before applying for a mortgage.

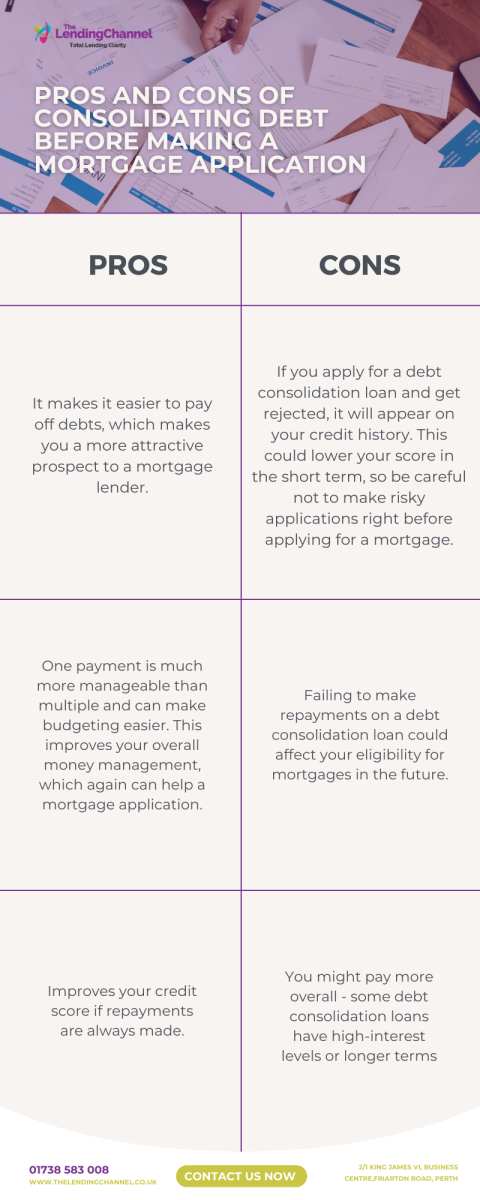

Pros and cons of consolidating debt before making a mortgage application

Pros for consolidating debt into a mortgage

- It makes it easier to pay off debts, which makes you a more attractive prospect to a mortgage lender.

- One payment is much more manageable than multiple and can make budgeting easier. This improves your overall money management, which again can help a mortgage application.

- Improves your credit score if repayments are always made.

Cons for consolidating debt into a mortgage

- If you apply for a debt consolidation loan and get rejected, it will appear on your credit history. This could lower your score in the short term, so be careful not to make risky applications right before applying for a mortgage.

- Failing to make repayments on a debt consolidation loan could affect your eligibility for mortgages in the future.

- You might pay more overall - some debt consolidation loans have high-interest levels or longer terms

What types of debt consolidation loans are there?

Unsecured debt consolidation loan

An unsecured debt consolidation loan allows you to roll all your debts into one without securing it against any asset. You'll likely be subject to some thorough credit checks to verify you can afford the repayments.

Unsecured loans are seen as a higher risk to a lender and tend to have higher interest rates. Notably, once you begin keeping up with monthly repayments this way, it should improve your overall credit score.

Can you get debt consolidation mortgages?

You can also take out a secured loan in order to consolidate debt. This means you'll borrow money against your assets, typically property, and is known as a debt consolidation mortgage. Depending on your situation, you might be an existing mortgage customer who would like to borrow more or you might want to remortgage with another lender.

This can be especially useful if you have a bad credit rating and/or want to pay a reduced interest rate on your loan, resulting in lower monthly payments. Because they're seen as lower risk for the mortgage provider, secured debt consolidation loans tend to be cheaper than unsecured loans.

However, you must proceed with caution, and it's vital to talk to a qualified fiancial advisor before going down this route. If you fail to make repayments, you're in danger of losing your property, and so you must be absolutely sure that it's the right decision for you.

Seek debt consolidation advice from an expert lender

As with most things in life, it’s much better to speak directly to a professional about your particular situation before making any decisions on your own. As debt consolidation can have a long term effect on your finances, it’s even more crucial to get in touch with a reliable mortgage broker who can provide debt advice based on your situation.

The Lending Channel is fully authorised and regulated by the Financial Conduct Authority (FCA) and an accredited member of the National Association of Commercial Finance Brokers (NACFB). With unrivalled market knowledge, we can help you find the best solution for you.

Don’t hesitate to contact us today for some free, no-obligation advice.

.jpg)

.png)