Family Finance: How to Support Your Loved Ones with Mortgages and Loans

"Home is where the heart is," goes the well-known saying. But in today’s world, buying a home isn’t just about finding the perfect place, it's also about overcoming financial hurdles.

As a parent or family member, you want the best for your loved ones—especially when it comes to helping them secure a future home. Yet, navigating mortgages and loans can be daunting.

How do you help your children buy their first home? What does it mean to share ownership of a property with a family member? These are real challenges that many families face.

But don’t worry—you’re not alone, and there are options available. In this blog, we’ll explore how you can support your loved ones in meaningful ways, from providing financial help for first-time buyers to understanding joint mortgages and navigating inheritance property.

We’ll take you step by step through the options available, the pros and cons, and offer practical advice along the way. Together, we'll ensure your family finance decisions are as informed and stress-free as possible.

Let’s explore how to turn your family’s dreams into reality—one step at a time.

How to Help Your Children Buy Their First Home: A Parent’s Guide

Buying a home is one of the biggest financial steps someone can take—and the current property market doesn’t make it easy for first-time buyers. As parents, you might feel a mix of excitement and stress. You want to help, but how do you do so without jeopardising your own financial stability?

Below, we'll explore various ways you can help your children buy their first home while ensuring your own financial wellbeing.

Gifting a Deposit: The Gift That Keeps on Giving

One of the most common ways parents help is by gifting a deposit. Whether it’s the full amount or a partial contribution, gifting a deposit can make a huge difference in getting your child onto the property ladder. A larger deposit often leads to better mortgage rates, making homeownership more affordable for your child in the long run.

However, before you start transferring funds, there are several things to consider:

Tax Considerations for Monetary Gifts

Firstly, gifting a significant amount of money may have tax implications. In the UK, if you gift money and pass away within seven years, the gift may be subject to inheritance tax.

To avoid any unexpected tax liabilities, it’s essential to discuss your plans with a financial adviser who can help navigate these complexities.

Impact on Personal Financial Stability

It’s also important to think about how gifting a deposit will impact your own financial stability. While it’s natural to want to help your children as much as possible, you need to ensure that you are not compromising your retirement savings or emergency fund.

Gifting a deposit should be something you can comfortably afford without jeopardising your own financial future.

Managing Family Dynamics and Expectations

Additionally, consider the implications for other family members. If you have more than one child, it’s crucial to communicate openly to prevent any feelings of unfairness or resentment.

You may even want to put your intentions in writing so that everyone understands your decision and the reasoning behind it.

Preparing for Paperwork

Finally, be prepared for some paperwork. Lenders often require proof that a deposit is a genuine gift and not a loan that will need to be repaid.

You’ll need to sign a declaration confirming this, so be ready for some administrative tasks to ensure the mortgage application proceeds smoothly.

Acting as a Guarantor: A Safety Net for Your Child

Another option is to act as a guarantor for your child's mortgage. By guaranteeing the loan, you make it easier for your children to access competitive mortgage rates, especially if they have a limited credit history or a lower income. Essentially, you’re providing the lender with additional security by promising to cover the repayments if your child cannot.

Understanding the Risks of Being a Guarantor

While this can be a great way to support your child, it’s important to fully understand the risks involved. Being a guarantor means that you are liable for the mortgage repayments if your child defaults. This could potentially impact your own finances and credit score. Before agreeing to be a guarantor, consider how this responsibility fits into your broader financial picture and whether it’s a risk you’re willing and able to take.

Planning for Financial Contingencies

It’s also worth discussing the potential scenarios with your child—what happens if they lose their job or face other financial hardships? Establishing a plan for how to handle such situations can help mitigate the risks and ensure that everyone is on the same page.

Providing a Loan: Flexible but Formal

Instead of gifting a deposit, you could consider providing an informal loan to your child. This option allows you to help your child while still protecting your own finances. However, it’s crucial to formalise the agreement in writing to avoid any future misunderstandings.

A written loan agreement should outline the repayment terms, including the interest rate (if any) and the repayment schedule.

This helps set clear expectations and prevents potential disputes later on. It’s also wise to discuss what might happen if your child is unable to meet the repayment terms due to unforeseen circumstances—having a contingency plan in place will help both parties feel more secure.

Buying Together: Joint Ownership

If your finances allow, another way to support your child is through joint ownership of the property. This means both you and your child are named on the mortgage and the property deeds. A joint mortgage can significantly increase borrowing power, making it possible to purchase a more suitable home.

Navigating the Complexities of Joint Ownership

However, joint ownership also comes with its complexities. You need to consider how the property will be divided if circumstances change, such as if your child wants to buy you out or if you want to sell your share.

It’s highly advisable to create a legal agreement—often called a "deed of trust"—which outlines each party’s financial contribution, ownership share, and what happens if one party wants to sell.

Understanding the Financial Impacts of Joint Ownership

Joint ownership can also impact your own financial situation. For instance, if you already own a property, purchasing a second property could result in higher stamp duty or capital gains tax when the property is eventually sold.

Again, professional advice is invaluable to ensure you fully understand the financial and tax implications.

Help with Monthly Payments: Shared Responsibility

If your child can manage a mortgage but could use some help with monthly repayments, you could contribute towards these payments directly. This approach reduces the burden on your child without the need for large upfront costs.

However, keep in mind that this arrangement requires ongoing commitment, so it’s essential to discuss how long you’re willing to contribute. It’s also crucial to be transparent about what happens if your financial circumstances change and you are no longer able to help.

The Emotional Side of Helping

Buying a first home is an emotional journey—not just for your child but for you as well. While financial support is incredibly valuable, so is your emotional support. Be there to celebrate the milestones, offer advice when needed, and guide your child through the ups and downs of the buying process. The property market can be overwhelming, and your experience and encouragement will be just as valuable as any financial contribution.

Remember, every family’s situation is unique, and there’s no one-size-fits-all solution. Whether you’re gifting a deposit, acting as a guarantor, or considering joint ownership, the key is to choose an option that works for both you and your child. Take the time to understand the financial and emotional implications, communicate openly, and don’t hesitate to seek professional advice.

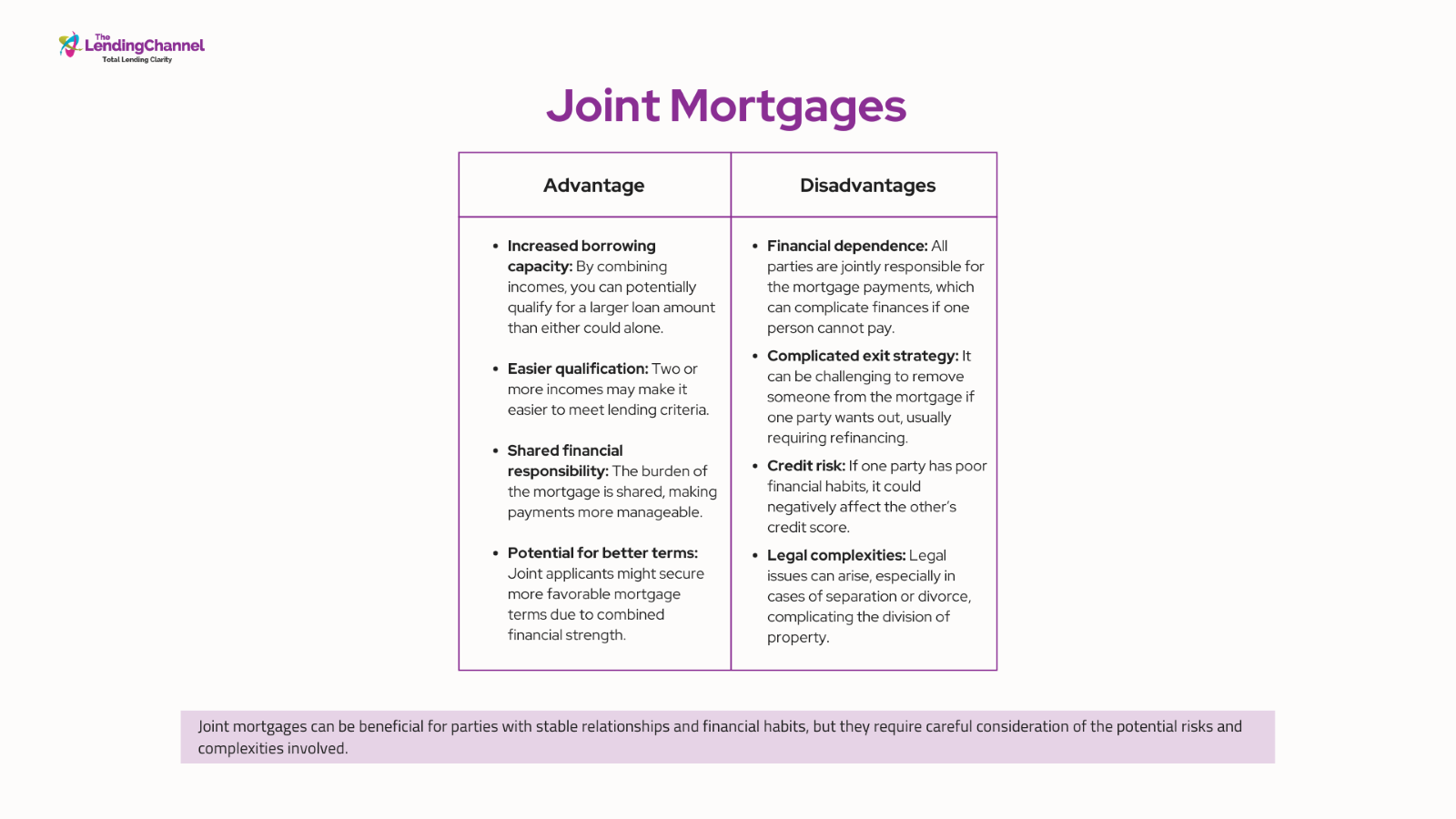

Joint Mortgages: What You Need to Know

Sometimes, joining forces is the best way forward.

A joint mortgage allows two or more people to combine their incomes to increase the amount they can borrow.

This is particularly useful if your loved ones wouldn’t qualify for a mortgage on their own.

Joint mortgages are common among couples, but they’re also becoming popular for parents and children or even siblings looking to buy property together.

The benefits are clear: pooling resources means a larger borrowing potential, making it easier to secure the right property. But it’s not without its challenges—joint mortgages mean shared responsibility. All parties involved are equally liable for the debt, and this can be a source of tension if financial circumstances change.

To avoid misunderstandings, it’s crucial to have clear agreements in place. Think about creating a "deed of trust," which outlines each person’s financial contribution and ownership share. This can make things much simpler if circumstances change down the road—such as when one party wants to sell their share.

Gifting a Deposit: Legal and Financial Considerations

You might think that gifting a deposit is as simple as transferring money into your child’s account, but there’s more to it than that. For one, you need to consider potential tax implications.

→ In the UK, if you gift money and pass away within seven years, the gift may be subject to inheritance tax. This is something to discuss with a financial adviser to ensure both you and your child are protected.

Moreover, lenders often require proof that a deposit is a genuine gift and not a loan that will need to be repaid. This ensures that the mortgage application proceeds without hitches. You’ll need to sign a declaration confirming this, so be prepared for some paperwork.

The Smart Way to Gift a Deposit Without Risking Your Future

It’s also important to think about how gifting a deposit might impact your own financial stability. While you may want to help your loved one as much as possible, gifting a large sum could affect your retirement plans or emergency savings. Before proceeding, ensure that the amount you are gifting is something you can comfortably afford without compromising your own future.

In addition, gifting a deposit can have implications for other family members. For example, if you have more than one child, it’s essential to consider how your financial assistance might be perceived. Open communication is key to avoiding any feelings of unfairness or resentment among siblings. You may even wish to outline your intentions in writing to ensure everyone understands your decision.

Finally, you should also be aware of potential benefits or drawbacks when it comes to means-tested benefits. If you’re planning to apply for financial assistance from the government in the future, gifting a large sum could impact your eligibility.

This is another reason why discussing your plans with a financial adviser is crucial—they can help you understand the broader impact of your decision and ensure that it aligns with your overall financial goals.

Buying Out Family Members: Navigating Inheritance and Shared Property

Inheritance can be an emotionally charged topic. When a family property is passed down, it's not uncommon for multiple family members to have a share. Perhaps you've inherited a property with siblings, and one of you wants to keep the property while the others prefer to sell their shares.

Buying out family members is a solution, but it requires a clear plan. Start by getting a professional valuation of the property so that everyone knows its true value. Then, negotiate a fair price for buying out their shares.

In addition to a fair valuation, consider the timing and method of payment. Some family members may prefer a lump sum payment, while others may be open to an instalment plan.

It’s important to agree on a payment schedule that works for all parties involved. In some cases, refinancing the mortgage on the property can be an effective way to fund a buyout. This allows the person keeping the property to pay off the others without dipping into personal savings.

Pro-tip from The Lending Channel: Remember, this isn’t just a financial transaction—family dynamics play a huge role. Honest communication is key to making sure everyone feels heard and treated fairly. Emotions can run high when it comes to inheritance, so approaching these discussions with empathy and openness is crucial. Be prepared for tough conversations, and consider involving a mediator if needed. A neutral third party can help facilitate discussions, ensuring that all voices are heard and that tensions are kept to a minimum.

Securing your agreement

It’s also wise to document the entire process. Creating a written agreement that outlines the terms of the buyout, including payment schedules and any contingencies, helps to prevent misunderstandings and ensures that everyone knows what to expect.

This document can be drawn up with the help of a solicitor to make sure it is legally binding and protects the interests of all parties involved.

Finally, consider the long-term implications of the buyout. For instance, what will happen to the property in the future? If the person keeping the property decides to sell it later, will the other family members have any claim to a portion of the proceeds? These are important questions to address early on to avoid future conflicts. Establishing a clear plan for the property’s future can help maintain family harmony and ensure that everyone is comfortable with the arrangements.

Managing Family Finances: Tips for Success

Family finance is all about balance—and keeping the balance requires planning, honesty, and collaboration. One of the first things to do is to sit down and have an open discussion about your finances. It’s crucial to understand each other’s expectations and limitations. This conversation may be uncomfortable, but it will help avoid misunderstandings down the line.

Consider setting up a joint savings plan if you’re all working towards a common goal, such as helping a younger family member buy a home. Joint savings accounts can simplify the process and make it easier to track your progress. However, always make sure that everyone is comfortable with their contributions—and remember, these arrangements require trust.

Setting Goals and Budgeting Smart

To keep things running smoothly, it’s also helpful to set specific goals and timelines. Defining what you’re saving for, how much you want to save, and by when can help keep everyone motivated and accountable. Whether it’s a deposit for a home, an emergency fund, or a family holiday, having a clear objective makes it easier to stay on track.

Another useful tool is budgeting. Creating a family budget allows you to allocate income towards joint expenses and individual needs.

This can be particularly useful if you have multiple goals to achieve, such as saving for a property while also managing day-to-day household expenses. Budgeting apps or spreadsheets can make this process more transparent and accessible for everyone involved.

It’s also essential to regularly review your financial progress. Set up monthly or quarterly family meetings to discuss how you’re doing, what’s working well, and where adjustments may be needed. This helps ensure that everyone stays informed and involved, and it provides an opportunity to celebrate milestones along the way.

Build Financial Unity with Trust and Expertise

Trust is a fundamental aspect of managing family finances, but so is respect for individual boundaries. Each family member should have the freedom to voice their concerns or opt out of contributing if their financial situation changes. Flexibility is key—life can be unpredictable, and being open to adjusting contributions or timelines will help maintain harmony within the family.

Lastly, consider seeking professional advice. Financial advisers can offer guidance on how best to manage family finances, taking into account everyone’s individual circumstances and long-term goals.

This can be especially helpful when navigating complex situations like joint investments or significant purchases, ensuring that everyone’s interests are protected.

Expert Tips: Ensuring Smooth Family Financial Transactions

- Communicate Clearly: Talk openly about expectations, contributions, and timelines. Misunderstandings can lead to conflicts, so it’s better to address any potential issues upfront.

- Consult a Professional: Whether it’s a mortgage adviser, tax expert, or solicitor, getting professional advice is invaluable. They can help you navigate legal complexities and make informed decisions.

- Plan for the Future: Think long-term. What happens if circumstances change? Plan for every scenario—whether it’s illness, job loss, or a change in living arrangements.

- Document Everything: When it comes to finances, putting things in writing is always a good idea. It helps prevent misunderstandings and keeps everyone on the same page.

FAQs: Common Concerns About Family Finance

Q: Can I help my child buy a home without impacting my own financial stability?

A: Yes, there are several ways you can help without jeopardising your own finances. For instance, you can gift a portion of the deposit, act as a guarantor, or contribute through a joint mortgage. It’s essential to evaluate your own financial situation and perhaps consult with a financial adviser before making any commitments.

Q: What are the risks of a joint mortgage with family members?

A: Joint mortgages mean shared liability. If one person is unable to meet their share of the repayments, the other borrowers must make up the difference. It’s crucial to have an agreement in place to handle unexpected changes.

Q: How does inheritance tax work if I gift money to my children for a deposit?

A: In the UK, if you pass away within seven years of gifting money, it may be subject to inheritance tax. It’s best to get professional advice to understand your specific situation and how you can minimise tax liabilities.

Building Stronger Futures at The Lending Channel

Supporting your family with mortgages and loans is a wonderful way to help secure their future. From gifting deposits to navigating joint mortgages and managing inheritance, there are multiple avenues available—each with its own set of challenges and rewards. The key is to stay informed, communicate openly, and get the right advice.

At The Lending Channel, we understand the importance of family and making the right financial choices together. Our experienced mortgage advisers are here to help you every step of the way—ensuring you make the best decisions for your loved ones.

Ready to start your family finance journey? Get in touch with us today and let’s make those dreams a reality.

.jpg)

.png)