Key Requirements for Securing a Commercial Property Loan

Whether you're looking to expand your workspace, relocate your business, or transition from renting to building equity in a property, our commercial real estate loans we offer at The Lending Channel can facilitate the acquisition of a new property without the need for immediate full payment.

When it comes to expanding your business, the need for extra capital to cover various expenses is quite common.

Instead of postponing your expansion while accumulating more working capital, consider leveraging commercial loans for construction and property purchases.

This approach can turn your expansion dreams into a reality much more quickly.

Nonetheless, navigating the landscape to find the most suitable loan option can pose its own challenges.

Here is what you should know to secure a commercial real estate loan in the current year, 2024.

.png)

The foundation for securing a commercial loan

At the core of any major business advancement, be it purchasing a new property, expanding existing premises, or constructing an entirely new facility, lies the potential of a commercial property loan.

At The Lending Channel, we understand that securing such a loan is more than a financial decision—it's a strategic move for your business's future.

Our role is to provide you with the latest, most relevant information and guidance to enhance your chances of loan approval.

We focus on a comprehensive approach, helping you to align your business objectives with the financial requirements of the loan.

Our expertise in the latest market trends and lending practices of 2024 ensures that you receive practical, tailored advice for a successful loan application.

With The Lending Channel, securing a commercial property loan becomes a streamlined, informed process, paving the way for your business's growth and success.

.png)

Essential criteria for commercial loan approval: What lenders look for

Securing a commercial loan hinges on meeting certain key criteria. Lenders typically evaluate your creditworthiness, require detailed financial documentation, conduct a property appraisal, and expect a solid business plan.

Understanding these factors can significantly boost your chances of approval:

Creditworthiness

When you apply for a loan, one of the first things lenders look at is your credit history and credit score.

This helps them gauge how reliably you've handled debt in the past and predict how likely you are to repay the new loan on time.

A higher credit score can significantly boost your chances of loan approval because it reassures the lender of your financial responsibility.

If your credit score isn't as high as you'd like, you might consider taking steps to improve it before applying for the loan, such as paying down existing debts or correcting any inaccuracies in your credit report.

Financial documentation

Be prepared to dig up quite a bit of paperwork. Lenders will want to see detailed financial documents that give them a clear picture of the health of your business.

This typically includes your business's financial statements (like profit and loss statements and balance sheets), recent tax returns, and possibly even personal financial information, depending on the structure of your business.

These documents help lenders assess your business’s financial stability and your ability to repay the loan.

Property appraisal

If you’re looking to purchase property, the lender will require an appraisal to ensure the property's value is sufficient to secure the loan.

An appraiser will assess the market value of the property based on various factors including location, condition, and comparisons with similar properties.

This is crucial for the lender to ensure that they have adequate collateral in the event of a default. It also gives you a safeguard, ensuring you're making a sound investment.

Business plan

Having a well-crafted business plan is crucial when seeking funding. Your business plan should outline your business's goals, the strategies you intend to employ to achieve these goals, a market analysis that shows your understanding of the industry and your competitors, and financial projections that demonstrate your venture’s potential profitability.

A strong, detailed business plan not only increases your chances of getting approved for a loan but also serves as a roadmap for your business's future growth and success.

Approaching lenders with these aspects well-prepared not only improves your chances of obtaining financing but also positions you as a savvy and serious business owner committed to success.

Checklist: Preparing your loan application package

- Business and personal financial statements

- Last two years of tax returns

- Property appraisal reports

- Business plan and projections

- Legal documents relating to your business (e.g., incorporation papers, leases)

Document requirements and financial benchmarks

|

Document Type |

Description |

Importance |

|

Credit report |

A detailed report of your credit history and score. |

Critical |

|

Financial statements |

Includes balance sheets, income statements, and cash flow statements. |

High |

|

Tax returns |

Personal and business tax returns for the last 2-3 years. |

High |

|

Business plan |

A detailed plan showing the purpose and projections for the loan. |

Medium |

|

Property appraisal |

An evaluation report of the property’s market value. |

Critical |

|

Legal documents |

Any relevant legal documents pertaining to your business (e.g., incorporation papers, leases). |

Medium |

|

Debt Service Coverage Ratio (DSCR) |

A measure of the cash flow available to pay current debt obligations. |

High |

|

Loan-to-Value Ratio (LTV) |

The ratio of the loan amount to the appraised property value. |

High |

|

Personal financial statement |

A document outlining the personal assets and liabilities of the borrower. |

Medium |

This table acts as a crucial checklist for applicants, ensuring they are prepared with all necessary documentation and meet the financial benchmarks for a successful commercial property loan application.

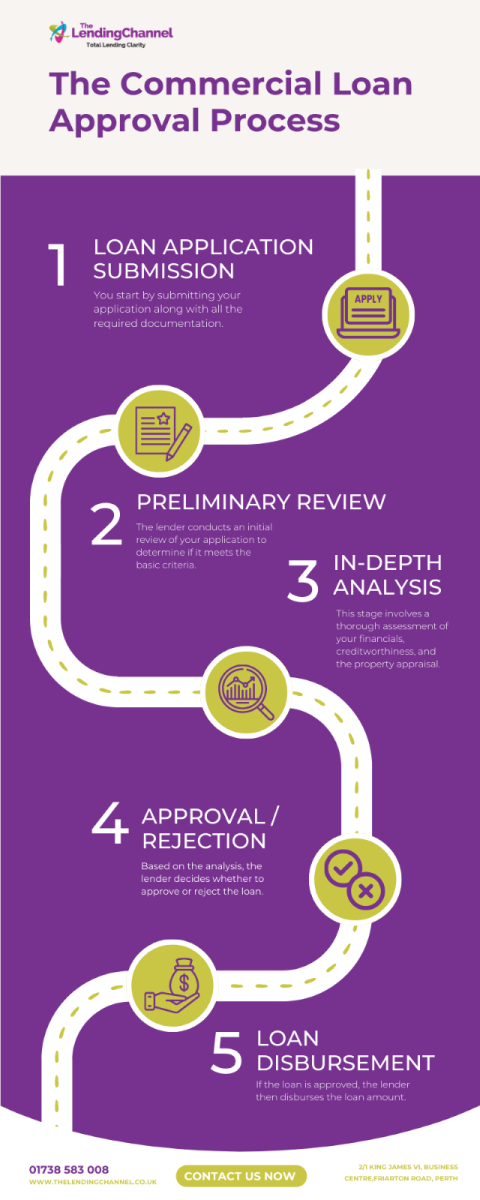

The commercial loan approval process

Our flowchart provides a clear and accessible visual representation of the Commercial Loan Approval process, guiding you through each key step from start to finish:

Loan Application Submission

Your journey begins here. You'll submit your loan application along with all the necessary documentation. This is your opportunity to put your best foot forward and make a strong initial impression.

Preliminary Review

At this stage, the lender conducts an initial review of your application to ensure it meets the basic criteria. This is a quick check to see if your application is complete and your requests align with their lending standards.

In-depth Analysis

Here's where things get thorough. The lender dives deep into your financial details, evaluates your creditworthiness, and appraises the property you’re looking to purchase. This comprehensive analysis is crucial as it determines the financial risk associated with lending to your business.

Approval/Rejection

Based on the in-depth analysis, the lender will make a decision. If your application meets all their criteria and financial guidelines, you’ll move forward. If not, it might be a rejection, but often with feedback that could help you improve your future applications.

Loan Disbursement

Congratulations are in order if you've reached this stage! Once approved, the loan amount is released to you, and you can proceed with your commercial investment.

Understanding each stage can help you better prepare and potentially increase your chances of a successful loan application.

Building a strong loan application

Building a strong loan application is essential for securing the financing you need for your commercial ventures. Here are some detailed steps to ensure your application stands out:

Maintain a good credit score

Your credit score plays a huge role in loan approval as it's a direct reflection of your financial reliability and history of debt management. A high credit score assures lenders of your ability to repay the loan on time.

Regularly check your credit report, correct any inaccuracies, and consistently pay your bills to maintain or improve your score.

Organise documentation

Having all your documents in order can significantly streamline the loan application process. Gather crucial paperwork such as business financial statements, recent tax returns, and any other relevant financial records.

Organising these documents properly ensures that you can quickly provide any information the lender might request, facilitating a smoother review process.

Develop a solid business plan

A well-crafted business plan is important. It should outline your business goals, the strategies for achieving them, detailed market analysis, and realistic financial projections.

This plan should not only demonstrate the potential profitability and viability of your business but also show that you have a clear, executable strategy in place.

It reassures lenders that you are a thoughtful and capable business owner with a plan for success.

Select appropriate property

If your loan involves purchasing property, the choice of property can heavily impact the assessment.

Opt for a property that not only serves your business needs but also holds strong market value.

Properties in desirable locations or those that are well-maintained usually fare better in appraisals, enhancing the overall strength of your loan application.

By diligently following these steps, you can enhance your loan application, making it robust and appealing to lenders, thereby increasing your chances of obtaining the necessary funding for your business endeavours.

Are you ready to apply for a commercial loan?

Before applying, review your financial status, business plan, and property choice. Make sure you meet the lender’s requirements and have all your documents in order.

Streamlining your loan acquisition journey

Securing a commercial property loan is a significant step in your business growth. By understanding and meeting the loan requirements, preparing your financial documentation, and presenting a strong application, you enhance your chances of approval. Remember, The Lending Channel is here to guide you every step of the way.

Ready to take the next step in your business journey? Contact The Lending Channel today to explore your commercial property loan options and pave the way to your business expansion.

Our team of experts is here to provide tailored advice and solutions to make your loan acquisition process as smooth as possible. Let's turn your business dreams into reality!

.jpg)

.png)