Overcoming Credit Challenges: A Guide to Securing a Mortgage with Poor Credit

Struggling with poor credit can feel like a never-ending uphill battle—especially when you dream of owning your own home. If you have a less-than-perfect credit score, the thought of applying for a mortgage might seem daunting, and maybe you've heard more "no's" than you care to count.

But here's the good news: securing a mortgage with poor credit isn't impossible. Thousands of people have been in your shoes and made it to the other side—with keys in hand.

In this guide, we’ll help you understand exactly what you need to do to overcome your credit challenges. We’ll look at your credit score in detail, explore different mortgage options for those with poor credit, and explain the role of a guarantor if you need a bit of extra support. With practical steps, expert advice, and real-life stories, you'll find a path to homeownership that suits you.

By the end of this guide, you’ll be equipped with all the information you need to make your homeownership dreams a reality—even if your credit history is far from perfect.

Understanding your credit score: What it means for your mortgage

A credit score is often seen as a measure of your financial reliability. When you’re trying to secure a mortgage, your credit score is one of the most important factors lenders consider. It tells them how well you've managed credit in the past and helps them assess how risky it might be to lend to you now.

A poor credit score could be due to several reasons—missed payments, defaults, or even having little to no credit history at all. If you’re looking for a "poor credit mortgage," it’s important to understand where your credit score stands and how it impacts your options.

Lenders use different scoring models, but generally, a credit score below 580 is considered poor.

This doesn’t mean you’re out of options; it just means you’ll need to take a slightly different route, and that might include higher interest rates or a need for additional security.

Still, it’s crucial to remember that your credit score is not set in stone. You can always work on improving it, which we’ll talk about in the next section.

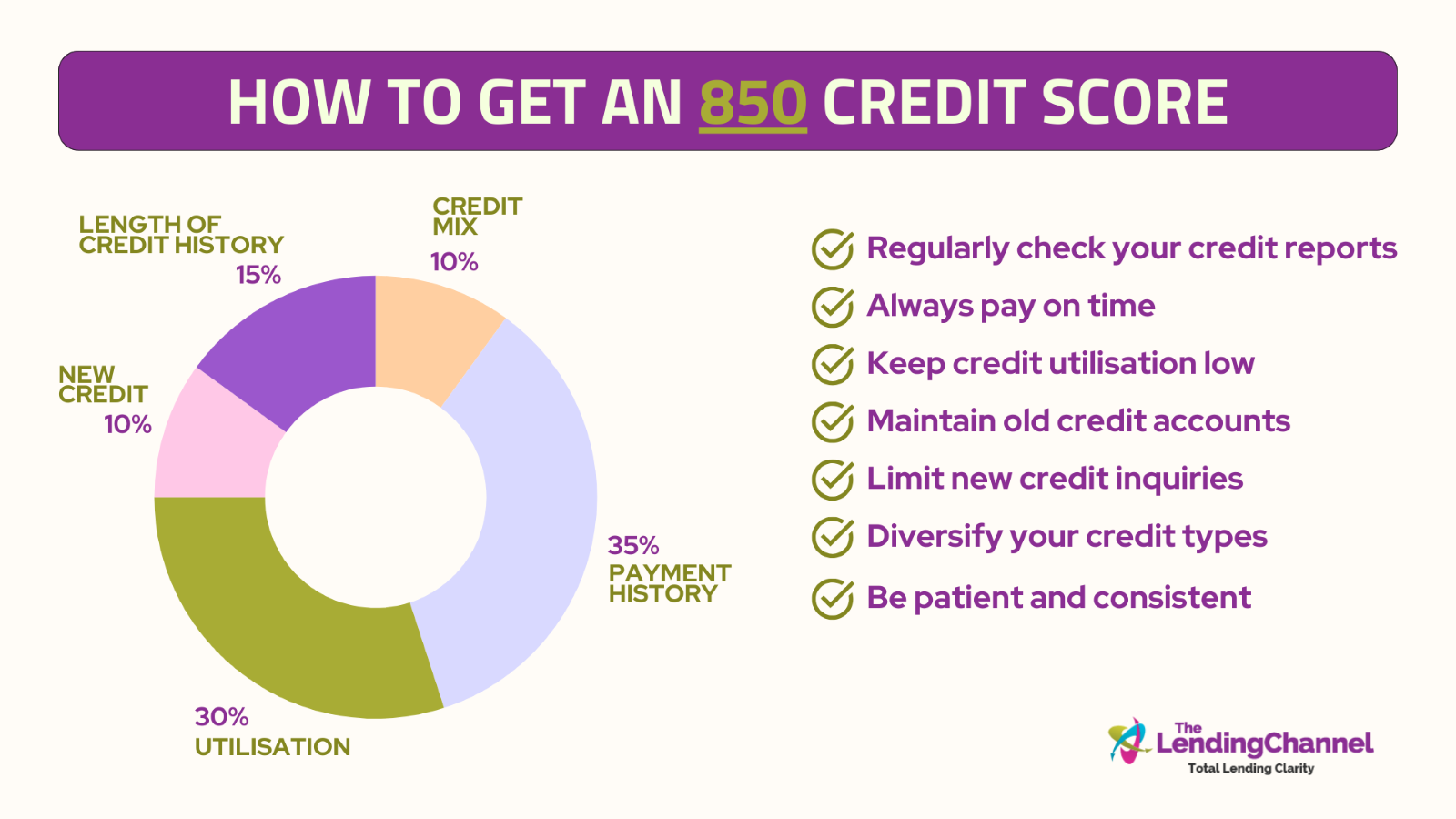

How to improve your credit score before applying for a mortgage

Improving your credit score takes time, but it’s one of the most effective ways to expand your mortgage options.

Here are a few actionable steps to consider:

Review your credit report

Start by requesting a free copy of your credit report. Look for errors—even something small like a misreported late payment can make a big difference to your score. Websites like Experian allow you to check your report for free.

Pay down debts

Lenders often look at your debt-to-income ratio to determine if you can afford a mortgage. Lowering your debt can not only improve your score but also make you more appealing to lenders.

Avoid new credit applications

Each time you apply for credit, it leaves a mark on your report. Too many applications in a short time can hurt your score, so it’s best to avoid applying for new credit while preparing for a mortgage.

Keep balances low

If you have credit cards, try to keep the balances low compared to your credit limit. Utilisation ratios play a big role in credit scoring models—aim to use less than 30% of your available credit.

Remember, these changes won’t happen overnight, but with persistence, you’ll start to see your credit score improve.

Settle any collections

If you have any accounts in collections, settle them. Paying off collections won’t remove the history from your credit report, but it will improve your overall credit profile and often increase your score.

Become an authorised user

Consider being added as an authorised user on a family member's credit card. Choose someone who has a long history of responsible credit use and a high credit limit. This can help bolster your credit score by adding positive payment history to your credit file.

Diversify your credit types

Having a mix of credit types, such as revolving credit (credit cards) and installment loans (auto, personal, or student loans), can positively affect your credit score. If you lack one type, consider obtaining a small loan or another credit line—only if it makes financial sense and you can manage it responsibly.

Consistently pay bills on time

Payment history is a significant factor in your credit score. Establish a record of on-time payments for all your financial obligations, not just credit cards and loans. Late payments, even by a few days, can significantly damage your credit score.

Limit the use of existing credit

Even if you're not applying for new credit, keeping your existing credit card use minimal can help. This demonstrates control over your finances by not relying too heavily on credit, which is attractive to lenders.

Regularly monitor your credit

Stay on top of your credit by setting up alerts with credit reporting agencies to monitor any significant changes or potential fraud. Regular monitoring can also help you track your progress and understand how your financial behaviours influence your score.

By implementing these strategies, you can improve your creditworthiness and expand your mortgage options, ultimately securing better rates and terms when you are ready to purchase a home. Remember, improving your credit is a process, but it’s a worthwhile one with long-term benefits for your financial health.

Mortgage options for those with poor credit

If your credit score isn’t perfect, you still have mortgage options.

Some lenders specialise in "bad credit loans," which cater to individuals with credit challenges. Let’s explore some of these options:

Subprime mortgages

These are designed for borrowers with lower credit scores. The trade-off is typically a higher interest rate, but they provide an opportunity for those who might be shut out of conventional mortgages.

Subprime mortgages can be a stepping stone—allowing you to secure a property while you work on improving your credit. Over time, if your credit score improves, you may have the option to refinance into a lower-rate mortgage.

Specialist lenders

In the UK, specialist lenders are available for those who don’t fit the traditional lending criteria. They can offer tailored solutions based on your unique situation, though again, rates might be higher.

Specialist lenders often take a more holistic view of your financial situation, considering factors like your income stability and overall financial behaviour, rather than just your credit score.

Using a mortgage broker

Working with a mortgage broker can help you identify lenders willing to work with your circumstances. A broker can navigate the market to find the best poor credit mortgage deal for you. Brokers often have access to a wider range of products, including some that aren’t available directly to consumers. They can also negotiate on your behalf, potentially securing better terms than you could on your own.

Credit union mortgages

Some credit unions offer more flexible lending criteria compared to traditional banks. They often have a community focus, which can make them more understanding of unique financial situations. If you’re a member of a credit union, it’s worth exploring whether they offer mortgage products that cater to those with poor credit.

Guarantor mortgages

As mentioned in the next section, a guarantor mortgage can also be an option for those with poor credit. This involves having a family member or close friend act as a guarantor, which provides the lender with added security. Guarantor mortgages can be a great way to secure a mortgage without needing an exceptionally high credit score, but they do require someone else to take on a significant level of responsibility.

The role of a guarantor: When and how to use one

A guarantor can be your golden ticket to securing a mortgage if your credit score is holding you back. Essentially, a guarantor is someone (often a close family member) who agrees to cover your mortgage payments if you can’t.

This extra layer of security gives lenders confidence that they won’t lose out, which makes them more willing to approve your application. A "mortgage guarantor" can make a real difference in your approval chances and also help you get better interest rates.

It’s a big commitment for the guarantor—they’re effectively putting their own financial stability on the line—so it’s important to have an open and honest discussion before proceeding.

How to write a good explanation letter for credit issues

Sometimes, explaining your situation clearly can make a big difference in the outcome of your mortgage application. If you have negative marks on your credit report, writing a good explanation letter can help a lender see beyond the numbers.

Tips for writing your letter:

- Be honest: Lenders appreciate honesty. If your credit issues were due to a specific event (e.g., job loss, medical bills), be transparent about it. Honesty helps build trust, and lenders are more likely to consider your application positively if they understand the context behind your credit issues.

- Take Responsibility and Show Growth: Explain what happened, but also mention the steps you’re taking to improve. This reassures the lender that you’re working on preventing future issues. For example, if you had missed payments due to unemployment, highlight that you’ve since found stable employment and have been making consistent payments on your current obligations.

- Keep It Concise: Aim for a straightforward explanation—keep your letter to one page. Avoid unnecessary details or overly complex language. Lenders appreciate clarity, and a concise letter is easier to process.

- Outline Mitigating Circumstances: If there were specific circumstances beyond your control—such as a medical emergency or a sudden job loss—briefly explain them. It helps to provide context for why the credit issues occurred and shows that they were not due to poor financial management.

- Highlight Positive Changes: If you’ve taken steps to improve your financial situation, make sure to mention them. This could include actions like reducing your overall debt, making on-time payments, or attending credit counselling. Demonstrating a proactive approach towards improving your financial health can significantly boost the lender’s confidence in you.

- Provide Documentation: If possible, attach supporting documents that back up your explanation. For instance, if a medical emergency led to missed payments, include relevant medical bills or records. Documentation can add credibility to your story and make your explanation more compelling.

- End on a Positive Note: Conclude your letter by expressing your commitment to staying financially responsible and your eagerness to work with the lender. A positive closing can leave a good impression and reinforce your determination to meet your financial obligations.

This letter is your chance to humanise your application and show the lender that you’re serious about taking care of your financial obligations moving forward. It can help bridge the gap between a simple credit score and your real-life circumstances, giving lenders a more complete picture of who you are as a borrower.

Expert tips: Navigating the mortgage process with credit challenges

At The Lending Channel, we understand how challenging it can be to navigate the mortgage process when you’re dealing with credit issues. It’s easy to feel discouraged, but we’re here to reassure you that there are options.

Here are some expert tips to help you through:

Start with a budget

It’s important to understand what you can realistically afford before you start the mortgage process. Knowing your budget will not only guide your application but also give you confidence in knowing what’s achievable.

Sit down and take a look at your income, expenses, and savings—being honest with yourself is the first step towards finding the right solution.

Shop around

Not all lenders are the same. Different lenders have different criteria, and just because one lender says no, it doesn’t mean they all will.

At The Lending Channel, we’ve helped many clients find lenders who are more understanding of their credit situations. Don’t be discouraged by the first hurdle; sometimes it’s about finding the right match.

Consider a broker

Mortgage brokers can be invaluable allies, especially when your credit situation is complicated. They know the market inside out and have access to a wide range of lenders, some of whom may not deal directly with borrowers.

A local mortgage broker can help identify which lenders are likely to work with your circumstances and can save you a lot of time and stress by guiding you through the process.

Save for a larger deposit

The more you can put down as a deposit, the better your chances of securing a mortgage. A larger deposit reduces the risk for the lender, which can make them more willing to work with you even if your credit score isn’t perfect. It also shows your commitment and ability to save, which can be a reassuring factor for lenders.

Review and repair your credit score

While it can take time, improving your credit score is within your reach. Start by obtaining a copy of your credit report and reviewing it for any inaccuracies. Dispute errors with the credit bureau and focus on paying down existing debts. Even small improvements in your credit score can significantly enhance your loan approval chances.

Seek professional advice

Don’t underestimate the value of professional financial advice. A financial advisor can provide personalized strategies to improve your financial situation and creditworthiness. They can also offer practical steps and long-term plans that align with your home buying goals.

Stay persistent and patient

The path to securing a mortgage with credit challenges isn’t always quick. It requires persistence and patience. Keep in close contact with your broker, and don’t be afraid to ask questions. Your situation can change, and opportunities to reapply may arise as your financial health improves.

Be prepared for extra documentation

Be ready to provide additional documentation if requested. This might include proof of income stability, tax returns, and financial statements. Demonstrating financial stability and an ability to manage your finances effectively can greatly support your application.

We know that navigating the mortgage process with credit challenges can feel like an uphill battle, but remember—you’re not alone.

At The Lending Channel, we specialise in helping people just like you. Whether it’s finding the right lender or offering advice on improving your application, we’re here to support you every step of the way. With the right guidance and perseverance, you can make your dream of homeownership a reality.

FAQs: Addressing common questions about credit and mortgages

1. Can I get a mortgage with a credit score below 500?

Yes, but your options may be limited to subprime lenders. You’ll also need to show a stable income and possibly a larger deposit.

2. What does a mortgage guarantor do?

A guarantor agrees to cover your mortgage payments if you cannot make them, which makes lenders more comfortable approving your mortgage.

3. How long does it take to improve my credit score?

The timeframe varies, but with consistent effort, you could see improvements within 6-12 months.

4. What are the risks of applying with a subprime lender?

Subprime lenders cater to individuals with lower credit scores, but the loans often come with higher interest rates and fees. It's crucial to weigh the costs against the benefits and consider whether you can manage the higher payments over the long term.

5. Can paying off outstanding debts quickly improve my credit score?

Yes, reducing your overall debt can positively impact your credit score, especially if you pay down high-interest, high-balance credit cards. This shows lenders that you're managing your finances responsibly.

6. What types of mortgages are more forgiving of poor credit?

FHA (Federal Housing Administration) loans, VA (Veterans Affairs) loans, and certain state-sponsored loan programs often have more lenient credit requirements compared to conventional loans. These programs are designed to help first-time homebuyers or those with credit issues secure financing.

7. How does a co-signer differ from a guarantor?

A co-signer is equally responsible for the mortgage and is listed on the property title, whereas a guarantor is only responsible if the primary borrower defaults. Guarantors aren’t typically named on the title.

8. What can I do if I'm denied a mortgage due to my credit score?

If you’re denied, the lender will provide a notice that explains the reasons for denial. Use this information to address the issues. This may involve paying off debts, correcting errors on your credit report, or saving for a larger down payment. Reapplying after making these adjustments can increase your chances of approval.

9. Does closing old credit accounts improve my credit score?

Contrary to common belief, closing old credit accounts can actually lower your credit score by shortening your credit history and reducing your total available credit. It's often better to keep older accounts open, provided they're not costing you money in annual fees.

10. What should I look for in a mortgage offer if I have bad credit?

Look for terms that are manageable within your budget, even if your options are limited. Consider the interest rate, term length, and any potential penalties for early repayment. It’s also important to read the fine print regarding any additional fees or insurance that might be required.

Final thoughts

Securing a mortgage with poor credit is absolutely possible, and while it may require extra effort, careful planning, and perseverance, there is a pathway to homeownership for you. It all starts with understanding your credit score, improving where you can, and exploring the options available to you.

Remember, your credit history is just that—history. It doesn’t have to define your future, especially with lenders who are willing to work with you. There are opportunities to secure a "poor credit mortgage" and make your dream of owning a home a reality. With the right strategies and support, those keys are closer than you think.

We're here to help—The Lending Channel has helped thousands of clients overcome credit challenges and secure the right lending solution. If you're feeling unsure or overwhelmed, remember that you don't have to face this journey alone.

Let us support you in finding the best path to homeownership.

.jpg)

.png)