Profile of a Commercial Borrower: Who They Are and What They Need

In finance, a borrower, be it an individual or a business entity, enters a collaborative relationship with a lender. At The Lending Channel, we understand that the success of this relationship hinges on a deep understanding of the borrower's nature.

We don't just facilitate loan eligibility for you, we pinpoint and help you recognise what commercial borrowers truly are.

From sole proprietors to corporations, each borrower has a unique profile, and it's our mission to talk about these intricacies, allowing you to lend with confidence.

What is a commercial borrower?

As we set out to unveil the essence of commercial borrowing, it becomes apparent that borrowers are not just entities receiving funds—they are dynamic players with distinct profiles.

The intricacies of loan structures, repayment terms, and the diverse nature of borrowers, whether individuals, partnerships, corporations, or non-profit organizations, shape the financial landscape.

Loan structures

Commercial borrowers engage with a range of loan structures, each tailored to address specific financial needs. From traditional term loans to lines of credit, these structures are instrumental in shaping the borrowing experience. Understanding the nuances of these structures allows borrowers to make informed decisions aligned with their financial objectives.

- Try our loan enquiry at The Lending Channel here.

Repayment terms

The essence of a commercial borrower is unveiled during the repayment phase. Repayment terms are contingent upon factors such as the borrower's profile, financial capacity, and the nature of the loan.

Whether adhering to a fixed-term loan with regular payments or navigating a more flexible arrangement, the repayment journey serves as a tangible demonstration of the borrower's commitment and financial responsibility.

Diverse nature of borrowers

Commercial borrowers form a diverse group, contributing to the richness of the financial landscape. Individual proprietors bring a personalized touch, partnerships showcase collaborative strength, corporations demonstrate resilience, and non-profit organisations reflect a commitment to societal welfare.

Each borrower type adds a unique dimension to commercial borrowing, creating a mosaic of financial interactions.

At The Lending Channel, our focus extends beyond facilitating loans. We are dedicated to empowering commercial borrowers with the knowledge required to make informed decisions. By comprehending the dynamics of commercial borrowing and acknowledging the distinctive nature of each borrower, we aim to facilitate successful and mutually beneficial financial journeys.

Who is a commercial borrower?

Commercial borrowers include a wide spectrum of individuals and entities, each contributing uniquely to the economic tapestry.

Let's break down the demographics to gain a comprehensive understanding:

Individual proprietors

Commercial borrowing isn't exclusive to large corporations. Individual proprietors, and entrepreneurs with singular visions and ambitions, constitute a significant demographic. These borrowers often bring a personal touch to their ventures, and understanding their financial needs is crucial to tailoring lending solutions.

Partnerships

Teamwork makes the dream work and partnerships thrive on teamwork. Whether it's a small business duo or a bigger collaborative venture, knowing how these partnerships work helps us create financial solutions that fit their shared responsibilities and goals like a glove. It's all about customising to make sure everyone's on the same page and moving forward together.

Corporations

Even big companies need to borrow sometimes. These corporations, with all their size and complicated workings, are a significant chunk of those looking for loans. Their money needs might be for big projects, growing their business, or just day-to-day operations. To help them out, it's crucial to really get how corporations work and what they need financially. By understanding their structures and requirements, we make sure the lending game is a win-win for both sides.

Non-Profit Organisations

Yes, non-profit organisations loan too! They might need money for community projects or daily operations. We get it – they're about doing good, not just making money. So, we offer simple, tailored loans that match their goals. Why? Because helping them today means supporting their ongoing mission to make a positive impact. It's all about funding good deeds in the simplest, most human way.

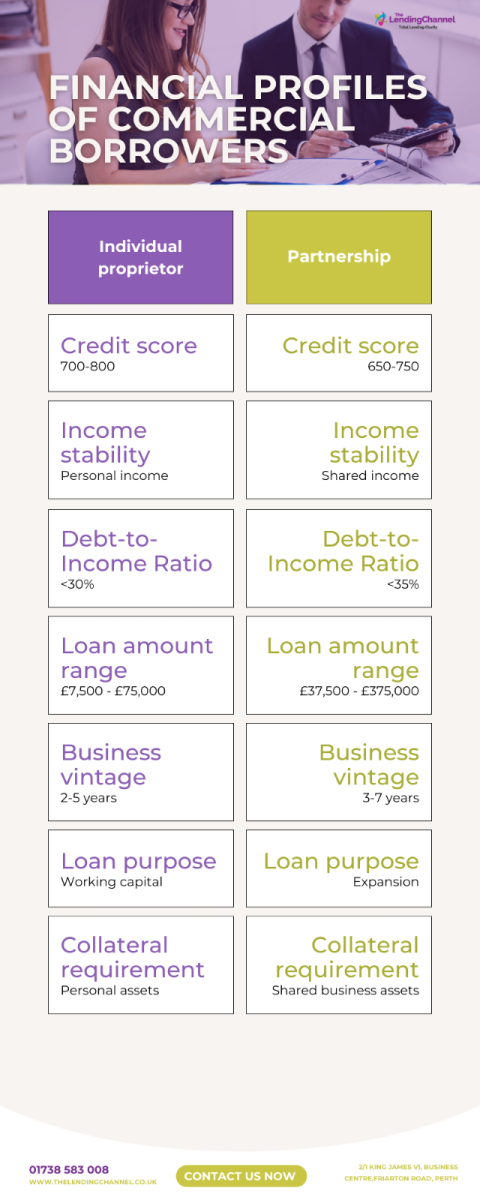

Typical financial profiles of commercial borrowers

This resource aims to guide financial institutions and borrowers alike in tailoring lending criteria or solutions that align with the unique needs of each group. Whether it's working capital for sole proprietors, expansion funds for partnerships, large-scale project financing for corporations, or operational support for non-profits, understanding these financial profiles is the key to fostering successful lending relationships.

Matching borrower profiles with loan products

|

Borrower profile |

Suitable loan products |

|

Individual proprietor |

Personal loans, short-term loans, working capital loans |

|

Partnership |

Business line of credit, term loans for partnerships |

|

Corporation |

Commercial mortgages, equipment financing, business expansion loans |

|

Non-profit organisation |

Grants, donor-backed financing, non-profit loans |

This table provides a starting point for understanding which loan products may be well-suited for different types of borrowers.

Keep in mind that individual circumstances and financial goals may vary, and it's advisable for both lenders and borrowers to engage in detailed discussions to determine the most appropriate financing options.

Assessing your borrower readiness

Starting on commercial borrowing begins with a critical self-assessment of your borrower readiness.

This involves evaluating your financial health, understanding your creditworthiness, and gauging your ability to meet loan obligations.

Assessing your borrower readiness is like taking stock of your financial fitness before embarking on a significant journey.

- Are your financial records in order?

- Do you have a clear understanding of your business's financial trajectory?

Answering these questions sets the foundation for a successful borrowing experience.

Understanding lender expectations and how to meet them

To successfully secure commercial financing, it's crucial to comprehend and align with lender expectations. Lenders seek assurance that borrowers are reliable and capable of repaying loans.

Understanding the specific criteria lenders use, such as credit scores, debt-to-income ratios, and business plans, empowers you to present a robust case for loan approval.

It's akin to understanding the language of lenders – what they look for and value in a borrower. By meeting these expectations, you not only increase your chances of approval but also foster a positive and collaborative relationship with your lender.

Strategic tips for aspiring commercial borrowers

Aspiring commercial borrowers can benefit from strategic tips to enhance their readiness and appeal to lenders.

These tips go beyond meeting basic criteria and involve positioning yourself as an ideal candidate for commercial loans. It's about presenting a compelling business narrative, showcasing your ability to manage risks, and demonstrating a clear plan for utilizing borrowed funds.

Think of it as crafting a roadmap for success that goes hand in hand with the lender's expectations.

These strategic tips are designed to elevate your profile in the eyes of lenders and set the stage for a successful commercial borrowing journey.

Positioning yourself as an ideal borrower

As you start securing commercial financing, remember that it's not merely about ticking boxes on a checklist. It's about crafting a narrative that resonates with lenders, demonstrating your commitment to financial responsibility and success.

By aligning your aspirations with the expectations of lenders, you not only increase the likelihood of loan eligibility–but also pave the way for a fruitful and enduring partnership.

Take the next step with The Lending Channel

Ready to turn your commercial borrowing aspirations into reality? The Lending Channel is your trusted partner in ticking off the boxes of the complexities in the lending criteria.

Our expert team is dedicated to helping you secure the financing you need with transparency, reliability, and strategic guidance. Position yourself as the ideal borrower and unlock the doors to your business's future.

Contact us now and let’s get started together.

.jpg)

.png)