Residential vs. Commercial Mortgages: Can You Convert for Commercial Property?

In the realm of property investment, the decision between residential and commercial mortgages is pivotal - each carrying its unique advantages and considerations. However, what if circumstances change, and your residential property evolves into a commercial venture?

Exploring the conversion from a residential mortgage to a commercial one unveils a complex but potentially rewarding journey. At The Lending Channel, we navigate the intricacies of this transition, shedding light on the feasibility and process involved.

Read on as we delve into the transformative world of residential-to-commercial mortgage conversions, empowering you with the knowledge needed to make informed decisions in your property investment journey.

Understanding the two mortgage worlds

Recognising the distinctions between residential and commercial mortgages is fundamental in property financing.

In this section, we’ll dive deep into each mortgage to better understand their function and purpose:

Residential mortgages

Residential mortgages are designed for properties intended for personal occupancy, whether as a primary residence, second home, or buy-to-let investment.

These mortgages function by providing individuals with funds to purchase or refinance residential properties, with the property itself serving as collateral.

The primary reasons to secure a residential mortgage include fulfilling the dream of homeownership, investing in property for rental income, or leveraging property appreciation for future financial growth.

Commercial mortgages

On the other hand, commercial mortgages are geared towards properties used for business or investment purposes, such as retail spaces, office buildings, or industrial units.

Unlike residential mortgages, which focus on individual borrowers, commercial mortgages evaluate the income potential of the property and the financial viability of the business occupying it.

Commercial mortgages enable entrepreneurs and investors to acquire or refinance properties that generate income, with the property's revenue stream often playing a significant role in the approval process.

How to know which one to get

The decision to opt for a residential or commercial mortgage depends largely on the intended use of the property and the financial goals of the borrower.

Residential mortgages appeal to individuals seeking to establish a home base or generate rental income from residential properties. Conversely, commercial mortgages offer opportunities for entrepreneurs and investors to expand their business operations, diversify their investment portfolio, or capitalise on income-producing properties.

Understanding the nuances of each mortgage type is essential for making informed decisions aligned with your long-term financial objectives.

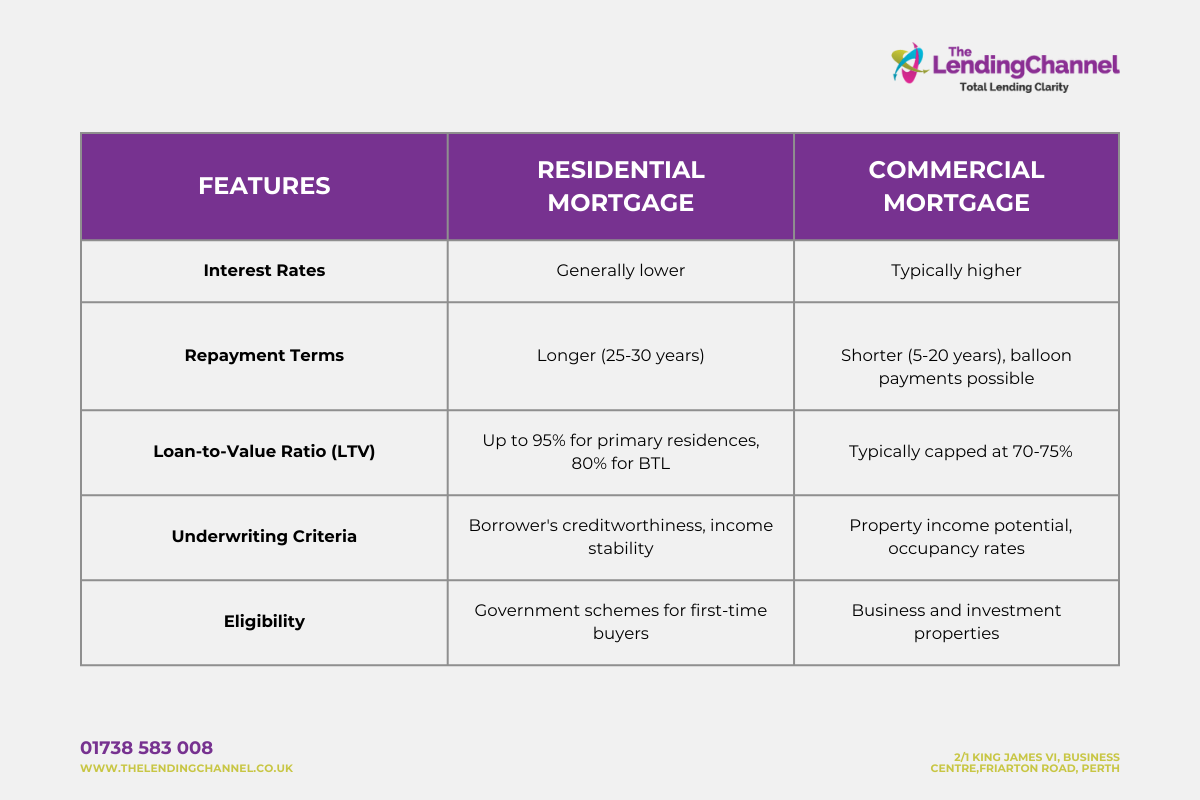

Residential vs. Commercial mortgage features

Distinguishing between residential and commercial mortgages extends beyond their intended use. Each mortgage type comes with distinct features and considerations that cater to the unique needs of borrowers. Understanding these features is crucial for individuals navigating the mortgage landscape.

Let's delve into a comparative analysis of the key features of residential and commercial mortgages to elucidate their differences and benefits:

Residential mortgage features

Residential mortgages are tailored to individuals seeking to purchase or refinance properties for personal use or rental income. Key features of residential mortgages include:

- Typically, lower interest rates compared to commercial mortgages.

- Longer repayment terms, often spanning 25 to 30 years.

- Loan-to-value ratios (LTV) typically up to 95% for primary residences and 80% for buy-to-let properties.

- Underwriting criteria focused on the borrower's creditworthiness, income stability, and debt-to-income ratio.

- Eligibility for government schemes and incentives, such as Help to Buy or Shared Ownership, aimed at assisting first-time buyers.

Commercial mortgage features

Commercial mortgages are designed for properties used for business or investment purposes, such as retail spaces, office buildings, or industrial units. Notable features of commercial mortgages include:

- Higher interest rates compared to residential mortgages, reflecting the increased risk associated with commercial properties.

- Shorter loan terms, typically ranging from 5 to 20 years, with balloon payments or refinancing required at the end of the term.

- Loan-to-value ratios (LTV) typically capped at 70% to 75%, depending on the property type and lender's risk assessment.

- Underwriting criteria based on the property's income potential, occupancy rates, and financial performance.

- Flexibility in structuring loan terms, including interest-only periods, adjustable rates, and tailored repayment schedules.

Comparison of residential and commercial mortgage features:

The conversion process: Legal and financial implications

Converting a residential mortgage to a commercial one can be a strategic move for property owners looking to maximise their investment potential or adapt to changing business needs. However, it's essential to understand the legal and financial implications involved in this process.

Let's explore the possibility of this process along with the legal and financial implications that come with it.

Is conversion possible?

Converting a residential mortgage to a commercial one is indeed feasible, but it's not a straightforward process. Lenders typically assess several factors before approving such a conversion, including the property's intended use, zoning regulations, and the borrower's financial stability. Additionally, property owners may need to seek permission from local authorities or planning departments to change the property's classification from residential to commercial.

Legal implications:

- Change of use permission: Depending on local zoning regulations, obtaining planning permission for change of use from residential to commercial is crucial. This process involves submitting applications to local authorities and may require architectural drawings and assessments.

- Compliance with building regulations: Converting a property to commercial use often necessitates compliance with specific building regulations, such as fire safety standards, accessibility requirements, and structural modifications.

- Leasehold considerations: If the property is leasehold, obtaining consent from the freeholder or landlord for commercial use is essential. Lease terms may also dictate restrictions or additional requirements for commercial conversions.

Financial implications:

- Valuation differences: Commercial properties are valued differently than residential properties, often based on income potential rather than comparable sales. As a result, the property's value and loan-to-value ratio may change upon conversion.

- Interest rates and terms: Commercial mortgages typically carry higher interest rates and shorter loan terms compared to residential mortgages. Borrowers should anticipate adjustments to interest rates and repayment structures post-conversion.

- Additional costs: Converting a property for commercial use may incur additional costs, including renovation expenses, professional fees for planning applications, and compliance with regulatory standards.

- Rental income potential: Commercial properties offer the opportunity for rental income, which can offset mortgage costs and enhance the property's investment value. However, fluctuations in market demand and tenant occupancy rates should be considered.

Overview of conversion requirements and procedures

Converting a residential property to a commercial one involves a meticulous process guided by specific requirements and procedures. Understanding these intricacies is essential for property owners seeking to transition their investment to a new realm of opportunity.

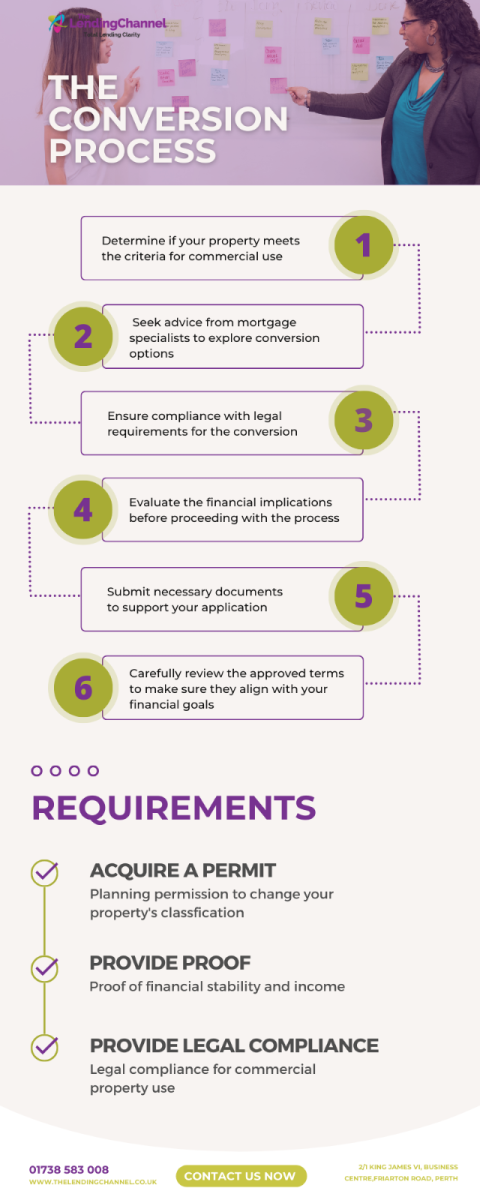

The conversion process

- Assessing eligibility: Property owners should first determine if their property meets the criteria for commercial use. This involves reviewing zoning regulations, lease agreements, and any applicable restrictions on property use.

- Consulting lenders: Property owners should engage with their current mortgage broker or seek advice from commercial mortgage specialists to explore conversion options. Lenders will assess the property's value, income potential, and the borrower's financial standing before approving the conversion.

- Legal considerations: Property owners must ensure compliance with legal requirements for converting residential properties to commercial use. This may involve obtaining planning permission, updating insurance coverage, and adhering to building code regulations.

- Financial implications: Converting a mortgage may involve additional costs, such as legal fees, valuation expenses, and potential prepayment penalties for existing residential mortgages. Property owners should carefully evaluate the financial implications of the conversion before proceeding.

- Documentation and application: Property owners will need to submit documentation related to the property, business plans, financial statements, and any other relevant information to support their application for a commercial mortgage.

- Approval and terms: Upon review of the application, lenders will determine the terms of the commercial mortgage, including loan amount, interest rates, repayment structure, and loan-to-value ratio. Property owners should carefully review and negotiate these terms to ensure they align with their financial goals.

Requirements for conversion

- Planning permission: Obtain approval from local authorities or planning departments to change the property's classification from residential to commercial.

- Financial documentation: Provide evidence of financial stability and income potential to support the commercial mortgage application.

- Legal compliance: Ensure compliance with all legal requirements for commercial property use, including building regulations, permits, and insurance coverage.

By carefully navigating the legal and financial aspects of the conversion process, you can leverage the flexibility and potential benefits of converting a residential mortgage to a commercial one, unlocking new opportunities for property investment and business growth.

Making an informed decision on mortgage conversion

Converting a residential mortgage to a commercial one can be a strategic move for property owners looking to maximise their investment potential and unlock new opportunities for business growth. However, navigating the legal, financial, and logistical complexities of this process requires careful planning and expert guidance.

At The Lending Channel, we understand the nuances of residential and commercial mortgages and are committed to empowering property owners with tailored solutions that align with their financial goals.

Our team of experienced mortgage specialists provides comprehensive support throughout the conversion process, offering expert advice, personalized guidance, and access to a wide network of lenders.

Ready to explore the possibilities of converting your mortgage or securing financing for your property investment? Contact us today to speak with one of our knowledgeable advisors and take the first step towards achieving your financial objectives.

Alternatively, explore our comprehensive guide section for valuable insights, tips, and resources on residential and commercial mortgages, designed to empower you with the knowledge needed to make informed decisions about your property investments.

Unlock the potential of your property with The Lending Channel. Reach out today and let us help you navigate the path to financial success!

.jpg)

.png)