The Ultimate Guide to Remortgaging: How to Unlock the Best Deals

Thinking about remortgaging but feeling overwhelmed by all the jargon and options? You're not alone.

Many homeowners find the idea of switching their mortgage to be confusing and stressful. However, finding the right remortgage can significantly reduce your monthly payments and offer much-needed financial flexibility.

In this guide, we'll simplify everything, showing you how to navigate the remortgaging process and how to secure the best deals out there. Let’s dive in and explore how you can make remortgaging work for you.

What is remortgaging and when should you consider it?

Remortgaging involves switching to a different mortgage deal while staying in your current home.

Typically, mortgage deals last between two and five years, distinct from the mortgage term, which can extend up to 40 years. Some mortgages even offer fixed interest rates for the entire 40-year term.

Homeowners often choose to remortgage at the end of their current deal to avoid moving to their lender’s more expensive standard variable rate (SVR).

You have two options:

- Switch to a new lender, known as remortgaging.

- Secure a new deal with your current lender, referred to as a product transfer.

Deciding whether to remortgage hinges on several considerations.

First, consider remortgaging if it offers clear benefits, such as:

- Securing a lower interest rate to reduce your monthly payments.

- Switching to a different mortgage type, like a fixed rate, to stabilize your monthly expenses.

- Allowing you to make overpayments if your current mortgage restricts this.

Additionally, your ability to secure a new mortgage may depend on your home’s value and your financial situation as assessed by your lender’s income and affordability checks.

Can I remortgage?

Yes, you can remortgage at any point, but there are several factors to consider first, such as:

- Your property's current market value.

- How much time is left on your existing mortgage deal.

- Your income and existing debt levels.

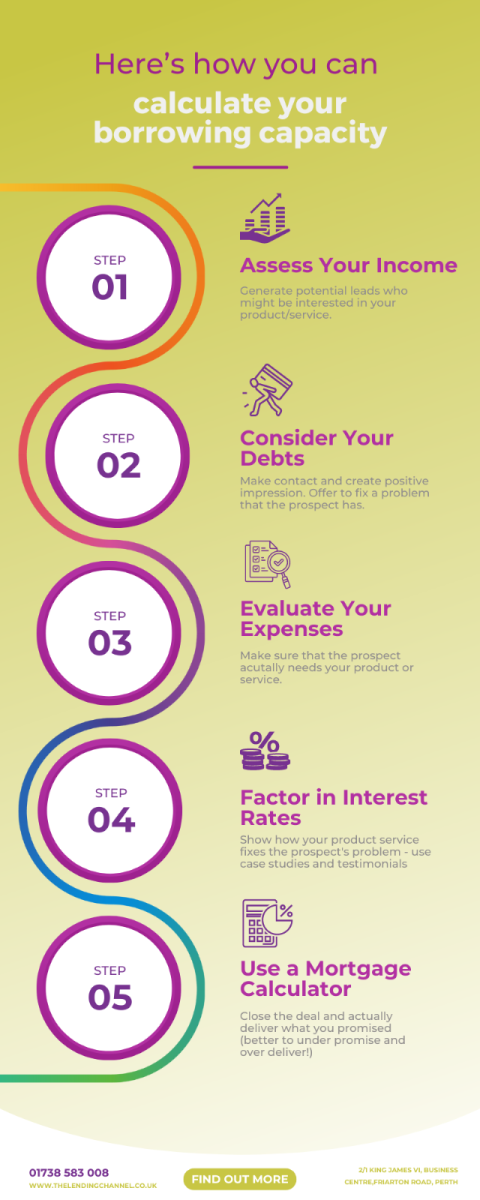

How to calculate your borrowing capacity

Calculating your borrowing capacity is crucial when considering remortgaging.

This figure determines how much you can realistically borrow based on your financial situation, helping you make informed decisions about potential new mortgage deals.

Here’s how you can calculate your borrowing capacity:

- Assess your income: Lenders primarily look at your income to determine how much they're willing to lend. This includes your basic salary plus any additional income from bonuses, overtime, or freelance work. The more stable and predictable your income, the better your chances of a favourable assessment.

- Consider your debts: Your existing debts, such as loans, credit cards, and other financial commitments, will affect your borrowing capacity. Lenders use a debt-to-income ratio to ensure that your debts do not exceed a certain percentage of your income.

- Evaluate your expenses: Regular outgoings like household bills, living costs, and other recurring expenses are taken into account. This helps lenders determine how much you can afford to repay each month after covering your essential living costs.

- Factor in interest rates: Current interest rates will influence how much you can borrow. Lower rates generally increase borrowing capacity as they reduce the monthly cost of repaying a mortgage.

- Use a mortgage calculator: Many lenders and financial websites, including us at The Lending Channel, offer mortgage calculators. These tools can help you estimate how much you might be able to borrow based on your income, debts, and the current interest rate.

Feel free to explore our mortgage calculator on The Lending Channel's website to get a clearer picture of your borrowing capacity and find the best remortgage options for your needs.

By understanding these components, you can gauge your borrowing capacity and explore remortgage options that align with your financial goals.

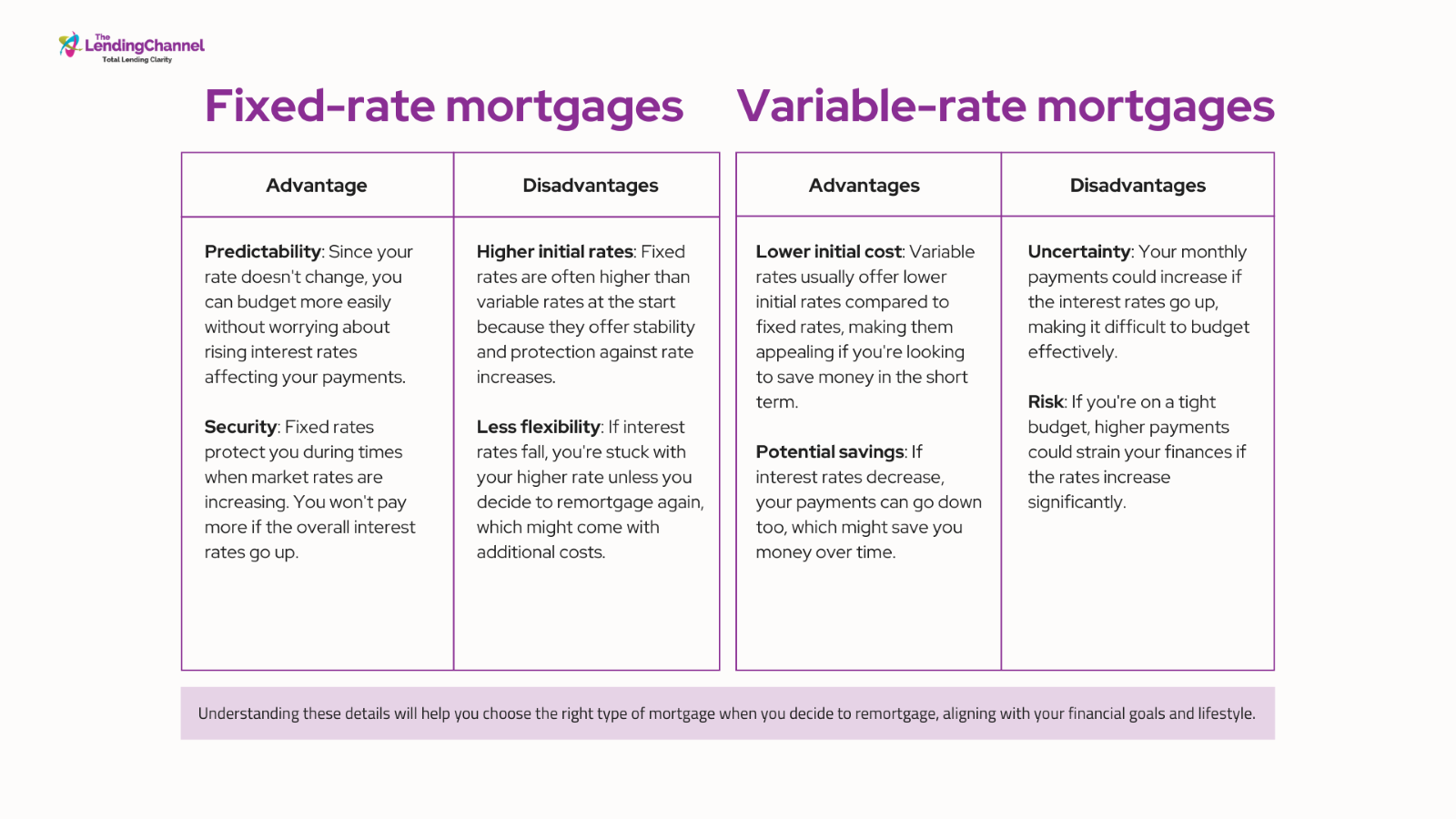

Understanding Interest Rates and Fixed vs. Variable Mortgages

When you remortgage, you'll need to choose between two main types of interest rates: fixed and variable.

Each has its benefits and drawbacks, depending on your financial situation and risk tolerance.

Fixed-rate mortgages:

A fixed-rate mortgage sets your interest rate for a specific period, keeping your monthly payments the same regardless of changes in the market. This period could last anywhere from one to ten years or longer.

Advantages:

- Predictability: Since your rate doesn't change, you can budget more easily without worrying about rising interest rates affecting your payments.

- Security: Fixed rates protect you during times when market rates are increasing. You won't pay more if the overall interest rates go up.

Disadvantages:

- Higher initial rates: Fixed rates are often higher than variable rates at the start because they offer stability and protection against rate increases.

- Less flexibility: If interest rates fall, you're stuck with your higher rate unless you decide to remortgage again, which might come with additional costs.

Variable-rate mortgages:

Variable-rate mortgages are tied to an index or a standard variable rate (SVR), meaning your payments can change based on economic conditions. This type of rate can fluctuate, leading to lower or higher monthly payments over time.

Advantages:

- Lower initial cost: Variable rates usually offer lower initial rates compared to fixed rates, making them appealing if you're looking to save money in the short term.

- Potential savings: If interest rates decrease, your payments can go down too, which might save you money over time.

Disadvantages:

- Uncertainty: Your monthly payments could increase if the interest rates go up, making it difficult to budget effectively.

- Risk: If you're on a tight budget, higher payments could strain your finances if the rates increase significantly.

Choosing between fixed and variable rates:

Risk tolerance

Consider how comfortable you are with the possibility of changing payments. If you prefer stability and predictable costs, a fixed rate might be better. If you're able to handle potential changes in payments and want to take advantage of possible decreases in interest rates, a variable rate could be suitable.

Financial flexibility

Evaluate your financial stability. If you have room in your budget to handle potential increases in payments, a variable rate might offer more benefits. However, if you need consistent payments to manage your finances effectively, choose a fixed rate.

Long-term planning

Think about how long you plan to stay in your home. If it's for many years, locking in a fixed rate might be wise to avoid future unpredictability. If you anticipate moving in a few years or believe rates will drop, a variable rate might provide more advantages.

Understanding these details will help you choose the right type of mortgage when you decide to remortgage, aligning with your financial goals and lifestyle.

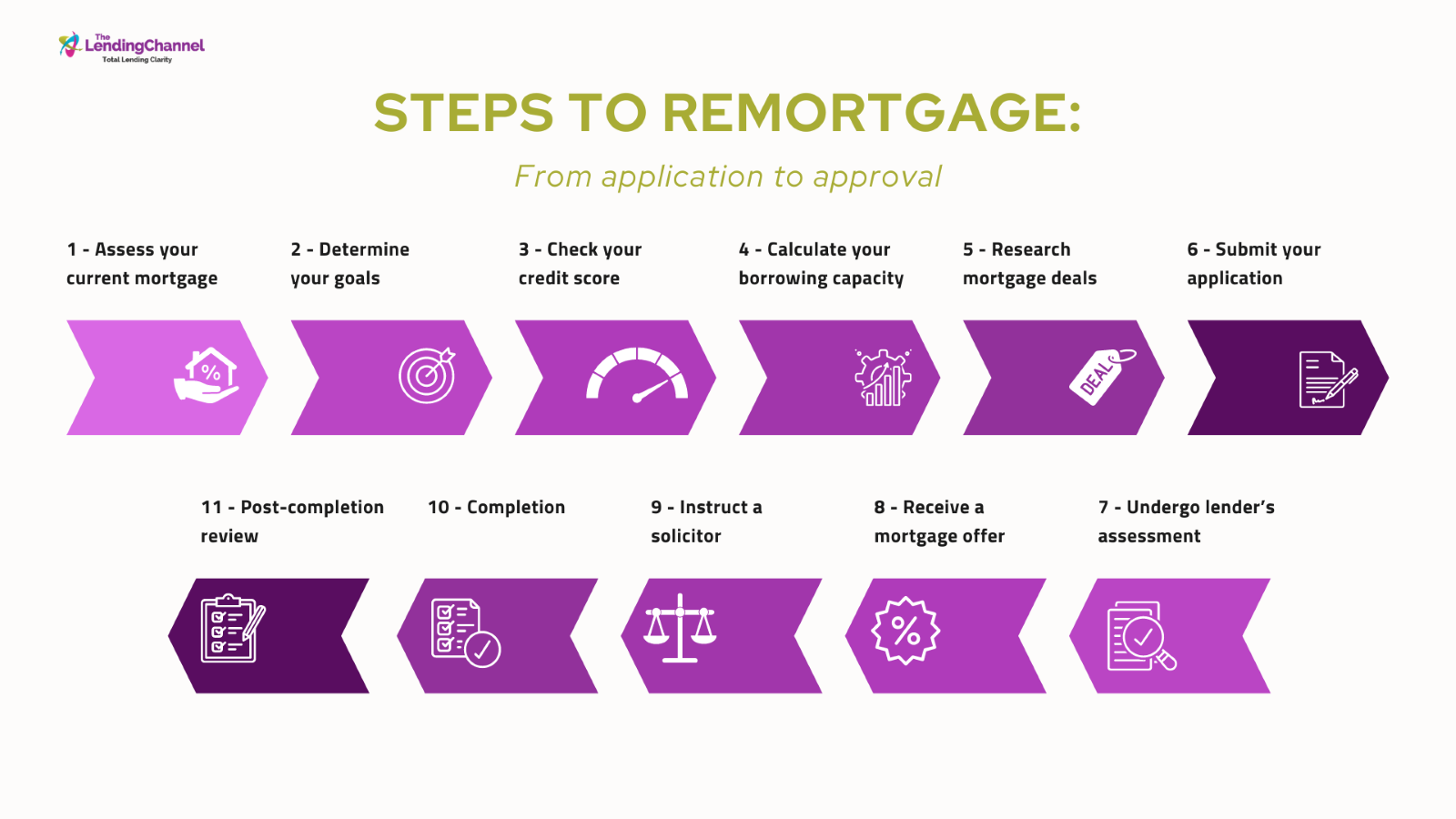

Remortgage steps: From application to approval

Remortgaging can seem like a complex process but breaking it down into manageable steps can make it much easier to navigate.

We’ve got you covered! Here’s a detailed look at the key stages you’ll go through from application to approval:

Assess your current mortgage

Before diving into the remortgaging process, start by reviewing your current mortgage. Look at the interest rate, remaining balance, and how long you have left on your term. Check if there are any early repayment charges or exit fees. Understanding these details will help you determine whether remortgaging is the right move and what potential costs you might incur.

Determine your goals

Next, clarify why you want to remortgage. Common reasons include securing a lower interest rate, releasing equity, moving to a fixed or variable rate, or consolidating debt. Having a clear objective will guide your decisions throughout the process.

Check your credit score

Your credit score plays a crucial role in your ability to secure a favourable remortgage deal. Obtain a copy of your credit report from a credit bureau and check for any errors or issues that might need addressing. A higher credit score can help you qualify for better rates and terms.

Calculate your borrowing capacity

Understanding how much you can borrow is essential. This involves assessing your income, existing debts, and monthly expenses. Many lenders offer online mortgage calculators to help you estimate your borrowing capacity.

The Lending Channel also has a mortgage calculator to guide you through this step.

Research mortgage deals

With your goals and borrowing capacity in mind, start researching potential mortgage deals. Compare interest rates, fees, and terms from various lenders. Consider whether you want to stay with your current lender or switch to a new one.

You might want to consult a mortgage broker who can help you navigate the options and find the best deal tailored to your needs.

Submit your application

Once you've selected a suitable mortgage deal, it's time to apply. This process typically involves filling out an application form and providing documentation such as proof of income, bank statements, and details of your current mortgage. If you're switching lenders, they may also require a property valuation to confirm its current market value.

Undergo lender’s assessment

After submitting your application, the lender will assess your financial situation, credit history, and the value of your property. They will check that you meet their lending criteria and that the remortgage makes financial sense for both you and them. This step might involve further questions or requests for additional documentation.

Receive a mortgage offer

If your application is successful, the lender will send you a mortgage offer. This document outlines the terms of the new mortgage, including the interest rate, fees, and repayment schedule. Review this offer carefully to ensure it meets your needs and expectations.

Instruct a solicitor

Once you've accepted the mortgage offer, you’ll need to instruct a solicitor or conveyancer to handle the legal aspects of the remortgage. They will manage the transfer of funds from the new lender to pay off your existing mortgage and ensure that everything is legally binding. This step typically involves signing the necessary legal documents.

Completion

On the completion date, your new mortgage will officially take effect. The funds from your new lender will pay off your existing mortgage, and any remaining funds (if you're releasing equity) will be transferred to you. Your solicitor will handle the final paperwork, and you’ll start making payments on your new mortgage according to the agreed terms.

Post-completion review

After the remortgage is complete, it's a good idea to review your new mortgage details and make sure everything is in order. Set up your new payment schedule, and keep an eye on your finances to ensure the remortgage benefits you as expected. It’s also worth noting when your new mortgage deal ends so you can plan ahead for your next remortgage or decide on other financial steps.

By following these remortgage steps, you can navigate the remortgaging process with confidence and secure a deal that aligns with your financial goals.

Common pitfalls and how to avoid them

Remortgaging can be a powerful tool to reduce your monthly payments, access better rates, or unlock equity in your home. However, it’s not without its challenges. Being aware of the common pitfalls can help you avoid costly mistakes and make the most of your remortgage.

We've listed down a detailed look at the most frequent issues and how you can steer clear of them:

Overlooking early repayment charges

One of the most common pitfalls in remortgaging is neglecting to consider early repayment charges (ERCs) on your existing mortgage.

Many mortgage deals come with a fixed period during which you must pay a penalty if you repay the mortgage early, including when you remortgage.

These charges can be substantial, often amounting to several thousand pounds.

How to avoid it: Before committing to a remortgage, check the terms of your current mortgage for any ERCs. Calculate whether the savings from remortgaging will outweigh the cost of the penalty. If the charges are too high, it might be worth waiting until the penalty period ends before remortgaging.

Not factoring in all the costs

While a lower interest rate can be appealing, many homeowners fail to account for the additional costs associated with remortgaging.

These can include valuation fees, legal fees, and arrangement fees from the new lender. These costs can quickly add up and eat into the savings you hoped to achieve.

How to avoid it: Get a clear understanding of all the costs involved in remortgaging. Some lenders offer fee-free remortgage deals, where they cover the cost of valuations and legal work. Compare these offers to those with lower interest rates but higher fees, and do the math to determine which option will save you more money overall.

Choosing the wrong type of mortgage

Another pitfall is selecting a mortgage product that doesn’t suit your long-term financial goals.

For example, choosing a variable rate mortgage when you need predictability in your payments, or locking into a long-term fixed-rate mortgage when interest rates are expected to drop.

How to avoid it: Consider your financial situation and future plans before choosing a mortgage. If stability is important, a fixed-rate mortgage may be the better choice. If you can tolerate some risk and are hoping to benefit from potential interest rate drops, a variable-rate mortgage might be more appropriate. Consulting with a mortgage advisor can also help you align your choice with your goals.

Overestimating your property’s value

Homeowners often overestimate their property’s value when considering a remortgage, expecting to unlock more equity or secure a better rate.

However, if the lender’s valuation comes in lower than expected, it can limit your borrowing capacity or even prevent you from securing the remortgage.

How to avoid it: Research the current market value of similar properties in your area to get a realistic estimate of your home’s value.

Consider getting an independent valuation before approaching lenders, so you have a clear understanding of what to expect. This way, you’ll be better prepared and less likely to be caught off guard by the lender’s valuation.

Ignoring your credit score

Your credit score is a crucial factor in determining whether you’ll qualify for a remortgage and what interest rate you’ll receive. Some homeowners neglect their credit score, only to find that they’re unable to secure the best deals or, in some cases, are rejected by lenders.

How to avoid it: Check your credit score before applying for a remortgage. If it’s lower than you’d like, take steps to improve it, such as paying down debts, correcting any errors on your credit report, and avoiding any new credit applications in the months leading up to your remortgage. A higher credit score can open doors to more favourable rates and terms.

Not shopping around

Many homeowners simply remortgage with their current lender out of convenience, missing out on potentially better deals elsewhere. While loyalty to your current lender might seem easier, it can cost you in the long run.

How to avoid it: Shop around and compare offers from multiple lenders. Use comparison tools and consider working with a mortgage broker who can help you find the best deals available.

Even if your current lender offers a reasonable deal, you might find a better one by looking elsewhere.

Failing to consider future changes

Remortgaging based solely on your current situation can be a mistake if you don’t consider how future changes might impact your ability to pay. This could include changes in your income, interest rates, or life circumstances such as starting a family or retiring.

How to avoid it: Think ahead and consider how different scenarios might affect your mortgage payments.

If you anticipate a potential change in your financial situation, opt for a mortgage that offers flexibility, such as the ability to make overpayments or switch to a different rate without penalties. This forward-thinking approach can save you from financial strain later on.

Overborrowing

With the lure of extra funds, it’s tempting to borrow more than you need when remortgaging. However, overborrowing can lead to higher monthly payments and increased interest over the life of the loan, putting you at financial risk.

How to avoid it: Only borrow what you genuinely need. Calculate your monthly budget to ensure that you can comfortably afford the repayments, even if interest rates rise in the future.

Remember that while accessing equity can be helpful, it’s still borrowed money that needs to be repaid with interest.

Overlooking flexibility

Some homeowners focus solely on getting the lowest rate and overlook the importance of having a flexible mortgage. This can limit your options if you want to make overpayments, take a payment holiday, or switch to a different product later on.

How to avoid it: Consider the flexibility of the mortgage product, not just the interest rate. Look for features like the ability to overpay, take payment holidays, or switch to another mortgage type without penalties. These options can provide valuable flexibility if your circumstances change.

Rushing the decision

Finally, rushing into a remortgage decision without thoroughly understanding the terms or considering all options can lead to regret later. Making a hasty decision might mean missing out on better deals or ending up with a mortgage that doesn’t suit your long-term needs.

How to avoid it: Take your time to research, compare deals, and consider your options. Don’t be pressured into making a quick decision. It’s worth spending extra time to ensure that the remortgage you choose aligns with your financial goals and offers the best possible terms.

By being aware of these common pitfalls and taking remortgage steps to avoid them, you can make a more informed decision and secure a remortgage that truly benefits your financial future.

Expert tips for securing the best remortgage deal

Securing the best remortgage deal requires a strategic approach and a bit of insider knowledge.

By following these expert tips, you can increase your chances of finding a deal that offers significant savings and aligns with your financial goals.

Start early and plan ahead

Timing is crucial when it comes to remortgaging. Don’t wait until your current deal is about to expire before you start looking for a new one. Begin researching and comparing options about six months before your current mortgage term ends. This gives you ample time to assess your options and avoid rushing into a decision.

By planning ahead, you can lock in a favourable rate and avoid slipping onto your lender’s standard variable rate (SVR), which is usually higher.

Improve your credit score

A higher credit score can open the door to better mortgage deals. Lenders use your credit score to assess your reliability as a borrower, so it’s important to ensure your credit profile is in good shape.

Check your credit report for any errors and work on improving your score by paying off outstanding debts, avoiding new credit applications, and ensuring you make all payments on time.

Even a small increase in your credit score can significantly impact the interest rates you’re offered.

Compare deals from multiple lenders

Don’t limit yourself to your current lender when searching for a new mortgage deal. Shop around and compare offers from multiple lenders, including banks, building societies, and online mortgage providers.

Each lender has different criteria and may offer various deals based on your financial situation. You might also want to consult a mortgage broker, who can help you navigate the options and find deals that you might not come across on your own.

Consider the total cost, not just the interest rate

While securing a low interest rate is important, it’s equally crucial to consider the total cost of the mortgage. This includes fees such as arrangement fees, valuation fees, and legal costs.

Sometimes, a mortgage with a slightly higher interest rate but lower fees can be more cost-effective in the long run.

Use a mortgage calculator to compare the total costs over the term of the mortgage, so you can make an informed decision.

Opt for a shorter fixed-term if rates are low

If interest rates are currently low, consider opting for a shorter fixed-term mortgage. This allows you to take advantage of the low rates without committing to a long-term deal. After the fixed period ends, you can reassess the market and potentially remortgage again to secure another favourable rate.

However, if you expect rates to rise, a longer fixed-term might provide more stability and protect you from future increases.

Check for flexible features

Look for mortgages that offer flexible features, such as the ability to make overpayments, take payment holidays, or switch to another deal without incurring penalties.

These features can provide valuable flexibility, especially if your financial situation changes during the mortgage term.

Overpaying on your mortgage, for instance, can help you pay off the loan faster and save on interest, while payment holidays can provide breathing room if you encounter financial difficulties.

Negotiate with your current lender

If you’re happy with your current lender but have found better deals elsewhere, use this as leverage to negotiate.

Contact your lender and ask if they can match or beat the offers you’ve found. Lenders often prefer to keep existing customers rather than lose them to competitors, so they may be willing to offer you a better deal to retain your business.

Be aware of fees and penalties

When switching to a new mortgage, be mindful of any fees or penalties that might apply, such as early repayment charges (ERCs) on your existing mortgage. Calculate whether the savings from the new deal will outweigh these costs.

If the fees are high, it might be worth waiting until your current mortgage deal ends before remortgaging. Additionally, some new mortgages come with exit fees if you decide to remortgage again before the term ends, so read the fine print carefully.

Consider your long-term plans

Your long-term plans can influence the type of mortgage deal that’s best for you. If you plan to move house in the next few years, a short-term or variable-rate mortgage might be more suitable.

On the other hand, if you’re settled and want stability, a long-term fixed-rate mortgage could be the better choice. Aligning your mortgage choice with your future plans ensures that your mortgage works for you in the long run.

Consult a mortgage broker

A mortgage broker can be invaluable in your search for the best remortgage deal. Brokers have access to a wide range of mortgage products, including exclusive deals that may not be available directly to the public.

They can also provide expert advice tailored to your specific circumstances, helping you navigate the complexities of remortgaging and find a deal that meets your needs.

By following these expert tips, you can secure a remortgage deal that offers the best possible terms, saving you money and providing peace of mind as you manage your home financing.

Remortgage with confidence

Remortgaging is a powerful financial tool that can help you save money, reduce your monthly payments, and better align your mortgage with your long-term goals.

However, it’s essential to navigate the process carefully, understanding the nuances of interest rates, calculating your borrowing capacity, and being aware of common pitfalls.

By taking a strategic approach—whether it’s comparing deals, improving your credit score, or planning ahead—you can secure a remortgage deal that truly benefits your financial future.

At The Lending Channel, we’re here to support you every step of the way.

With our expert advice, comprehensive mortgage calculators, and access to a wide range of lenders, we make it easier for you to find the best remortgage deal tailored to your needs.

Whether you’re looking for a lower rate, greater flexibility, or just some guidance on where to start, we’re ready to help you unlock the potential of your mortgage.

Explore your remortgage options

Ready to explore your remortgage options? Visit The Lending Channel today and use our mortgage calculator to see how much you could save.

Our team of experts is here to answer your questions and guide you through the process, ensuring you get the best deal possible.

Don’t leave your financial future to chance—let us help you secure a remortgage that works for you. Contact us today to get started!

.jpg)

.png)