Understanding Commercial Mortgage Rates: Factors and Trends

For companies looking to refinance their existing debts or finance new real estate acquisitions, the significance of commercial mortgage rates cannot be overstated. These rates vary greatly depending on various factors, including the lender's policies, the credit standing of the borrower, and the type of property being financed.

Grasping the various factors that impact commercial mortgage rates is crucial for borrowers. It helps them make well-informed choices when securing funding for their commercial mortgage ventures.

That’s why in this blog, we will talk about the key factors that influence commercial mortgage rates and offer guidance to borrowers aiming to secure the most favourable rates for their commercial property investments.

The dynamics of commercial mortgage rates

Commercial mortgage rates, often perceived as mere figures, are in fact reflective of the broader economic climate and the confidence prevalent in the market. They act as barometers for economic stability and investor sentiment. For investors and business proprietors aiming to finance commercial properties, comprehending the nuances of these rates is essential.

These rates are influenced by a complex interplay of factors including monetary policy, market demand, and the overall health of the real estate sector. For instance, when the Federal Reserve adjusts interest rates, it directly impacts commercial mortgage rates.

Similarly, the demand and supply dynamics of commercial properties can cause rate fluctuations. In booming markets, where demand for commercial spaces is high, lenders might hike rates, capitalising on the increased demand.

Conversely, in slower markets, rates might be lowered to attract borrowers. This intricate web of factors makes understanding commercial mortgage rates crucial for making sound investment decisions, as they can significantly impact the cost of borrowing and the overall return on investment.

The economic indicators that influence rates

Economic indicators are crucial in shaping commercial mortgage rates, as they give lenders insights into the health of the economy and the risk associated with lending. Three key indicators typically stand out:

- Inflation: As the general level of prices rises, lenders may increase interest rates to maintain their profit margins. Inflation erodes the purchasing power of money, meaning lenders need higher returns to compensate for the decrease in value over time.

- Gross Domestic Product (GDP) Growth: This indicator reflects the overall economic health. Strong GDP growth signals a robust economy, which can lead to higher commercial mortgage rates. In a growing economy, businesses are more likely to expand, increasing the demand for commercial loans. Conversely, in a recession, lenders might lower rates to stimulate borrowing and investment.

- Employment Rates: Employment levels give lenders a sense of economic stability. High employment rates suggest a strong economy where businesses are more likely to succeed, thus reducing the risk for lenders. In such scenarios, lenders might increase rates, reflecting the lower risk associated with lending. On the flip side, high unemployment can lead to lower rates as lenders strive to encourage borrowing in a riskier economic environment.

Understanding these indicators and their current trends is essential for borrowers. They not only affect the rates but also indicate the potential risks and opportunities in the commercial real estate market. By closely monitoring these economic indicators, borrowers can better time their borrowing decisions and negotiate more favourable terms.

Trends and patterns: A statistical overview

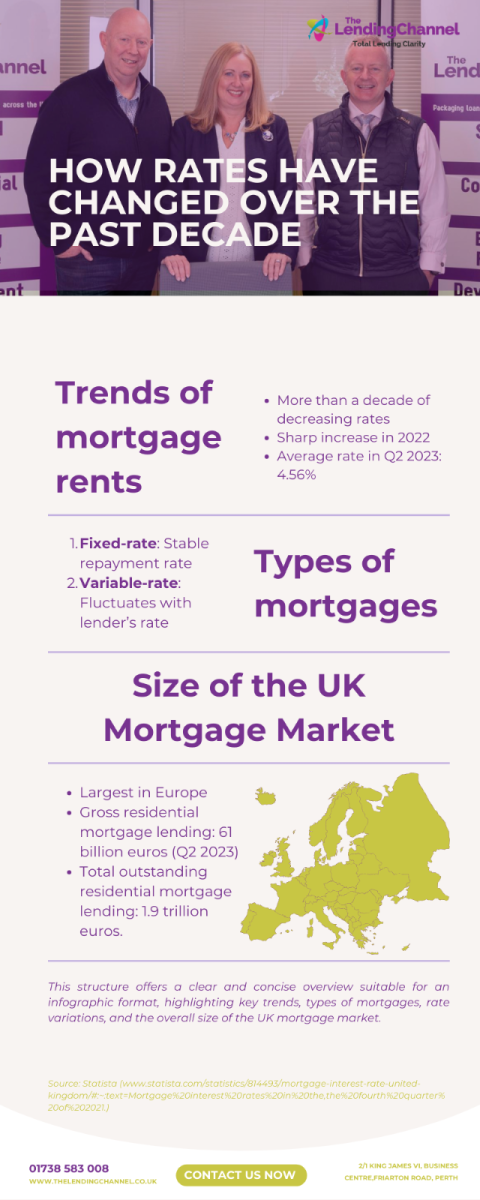

The UK's commercial mortgage landscape has undergone significant shifts in recent years, marked by a notable trend in mortgage interest rates. After more than a decade of a downward trajectory, there was a sharp increase in 2022. By the second quarter of 2023, the average weighted interest rate had climbed to 4.56 percent, almost tripling from the rate observed in the fourth quarter of 2021. This change is indicative of broader economic shifts and monetary policy adjustments, reflecting a dynamic market environment.

The UK mortgage market is not just dynamic but also substantial in size. It stands as the largest mortgage market in Europe, with gross residential mortgage lending reaching nearly 61 billion euros as of the second quarter of 2023. This magnitude is further emphasised when considering the total outstanding residential mortgage lending, where the UK leads with approximately 1.9 trillion euros.

This scale reflects the importance of the mortgage market in the UK's economy and underscores the need for understanding the nuances of mortgage rates and their trends for anyone involved in the real estate and lending sectors.

Future predictions: What the experts are saying

When it comes to commercial mortgage rates, forecasting the future involves a blend of economic analysis and market intuition. Experts in the field often look at a range of indicators and trends to make educated predictions about where rates might head.

Key factors influencing these predictions include current economic policies, anticipated moves by central banks (like the Bank of England), global economic trends, and domestic market conditions.

- Economic policy changes: Experts analyse government and central bank policies, such as changes in interest rates or quantitative easing measures, which can significantly impact mortgage rates.

- Global economic trends: The interconnectedness of global markets means that events in one part of the world can ripple through to mortgage rates in the UK. For instance, economic slowdowns in major economies or global trade tensions can influence rates.

- Inflation expectations: Inflation is a crucial factor in rate-setting. If experts anticipate higher inflation, they often predict an increase in mortgage rates as lenders aim to maintain their profit margins.

- Housing market dynamics: The state of the housing market, including demand for housing, housing supply, and house price trends, is also a critical consideration in forecasting mortgage rates.

How to lock in the best rates: strategies for borrowers

For borrowers, securing the best possible commercial mortgage rate can lead to significant savings over the life of the loan. Several strategies can help in achieving this:

- Improve creditworthiness: A strong credit score and a solid financial history make borrowers more attractive to lenders, often leading to better rates.

- Choose the right mortgage type: Depending on the economic climate and personal circumstances, choosing between a fixed-rate and a variable-rate mortgage can impact the overall cost of the loan.

- Timing: Borrowers should stay informed about market trends and economic indicators to time their mortgage application when rates are relatively lower.

- Shop around: Comparing offers from multiple lenders can lead to more competitive rates. It’s not just about the headline rate but also about the overall cost of the mortgage, including fees and terms.

- Negotiation: Don't hesitate to negotiate with lenders. If you have a strong borrowing profile or are bringing a substantial down payment, you may have leverage in negotiations.

- Shorter loan terms: Sometimes opting for a shorter loan term can result in lower interest rates, though this will increase monthly payments.

- Professional advice: Consulting with a financial advisor or a mortgage broker who understands the nuances of the market can provide insights and help in securing the best rates.

By combining these strategies, borrowers can position themselves more favorably in the lending market and secure more advantageous terms on their commercial mortgages.

Keeping up with rate changes

With that being said, staying informed about commercial mortgage rate changes is crucial for anyone involved in commercial investments. This blog has provided a comprehensive overview of the factors affecting these rates, current trends, expert predictions, and strategies to secure the best rates. Remember, the world of commercial mortgages is dynamic, and keeping abreast of these changes can significantly impact your investment success.

If you’re looking to invest in commercial real estate or refinance your existing property, understanding commercial mortgage rates is just the start.

Contact our team at The Lending Channel for a personalised advice and services tailored to your goals.

.jpg)

.png)