What Is An Interest Only Mortgage

Did you know that interest-only mortgages make up just 9% of the total number of regulated mortgages in the UK? For many entrepreneurs and business owners, managing financial commitments while pursuing growth can be challenging.

An interest-only mortgage might just be the solution that provides the flexibility needed to stay on track.

But what exactly is an interest-only mortgage, and why should you care?

This guide will answer all your questions, demystify the process, and help you decide if this type of mortgage is right for you. By understanding the pros and cons, you'll be equipped to make an informed decision that supports your long-term financial goals. So, let's dive in.

What is an Interest-Only Mortgage?

An interest-only mortgage is a type of home loan where, for a set period, the borrower is only required to pay the interest on the loan and not the principal.

During this time, monthly repayments are considerably lower compared to a standard repayment mortgage, which requires payments on both interest and principal from the start.

After the interest-only period ends, borrowers are either required to pay off the remaining principal in one lump sum or begin making higher monthly repayments that cover both principal and interest.

Interest-only mortgages are often considered by those who need lower monthly payments in the short term, such as business owners with seasonal income or individuals looking to invest their spare funds into their businesses instead of paying down mortgage debt immediately.

However, they do come with unique challenges and potential risks.

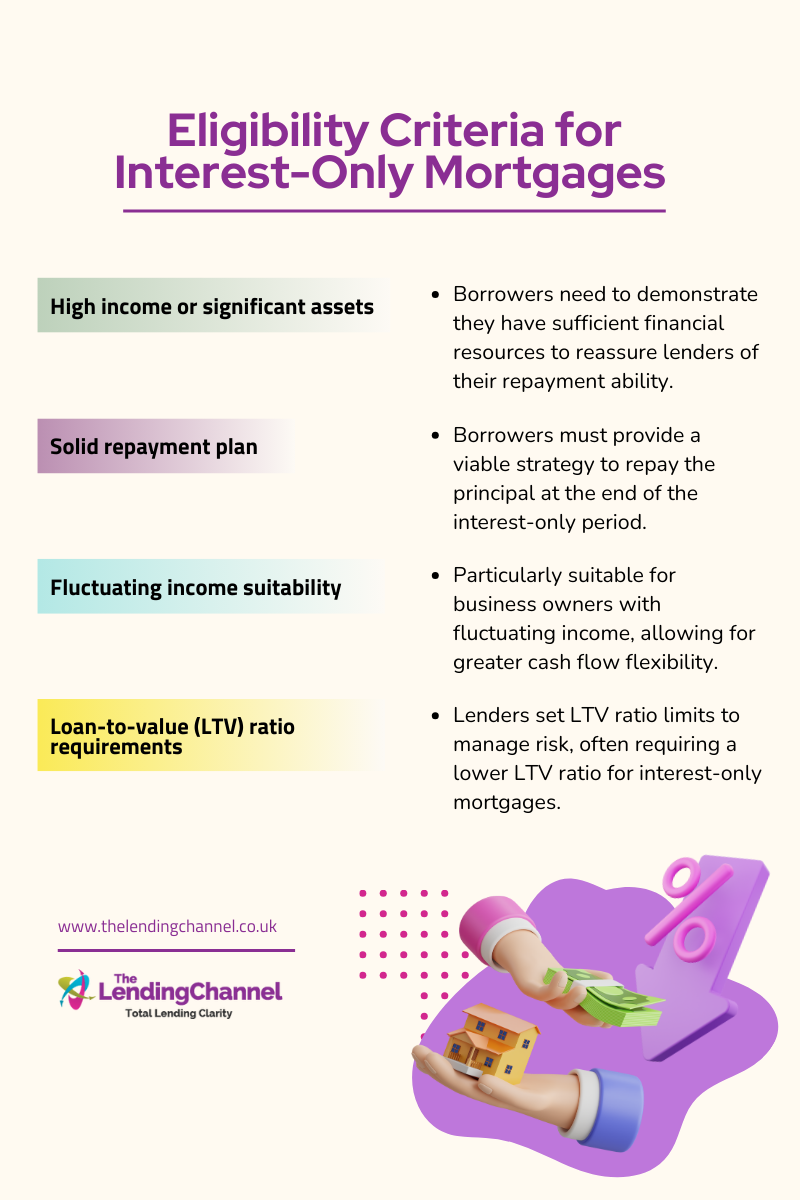

Eligibility Criteria for Interest-Only Mortgages

Not everyone will qualify for an interest-only mortgage, as lenders set specific requirements to mitigate their risk. Typically, eligibility depends on the borrower's income, loan-to-value (LTV) ratio, and the ability to prove a solid repayment plan for the principal at the end of the interest-only period.

To simplify it, here are some key eligibility criteria:

-

High income or significant assets: Borrowers need to demonstrate they have sufficient financial resources to reassure lenders of their repayment ability.

-

Solid repayment plan: Borrowers must provide a viable strategy to repay the principal at the end of the interest-only period.

-

Fluctuating income suitability: Particularly suitable for business owners with fluctuating income, allowing for greater cash flow flexibility.

-

LTV requirements: Lenders set LTV ratio limits to manage risk, often requiring a lower LTV ratio for interest-only mortgages.

Borrowers generally need a high income or significant assets to be eligible. Lenders want reassurance that they can either save up for the lump sum payment or refinance when the time comes. Business owners with substantial income variability might find this type of mortgage suitable if they have high earnings during certain periods and need cash flow flexibility in others.

Benefits of Interest-Only Mortgages

Interest-only mortgages offer several advantages, particularly the significantly lower monthly payments during the interest-only period.

This feature provides entrepreneurs with greater cash flow flexibility, allowing them to allocate capital towards business ventures or other investments rather than tying it up in property repayment.

Additionally, this type of mortgage can offer short-term financial relief for borrowers with fluctuating incomes, making it easier to manage finances during periods of lower earnings.

Lower Monthly Payments

During the interest-only period, the monthly outgoings on a mortgage are considerably lower, as payments are being made only towards the interest. This can significantly help with cash flow management, especially for businesses that are in the growth phase and need liquidity for investments and day-to-day operations.

Investment Flexibility

The money saved on monthly payments can be used to make other potentially higher-yield investments. This flexibility is particularly appealing to business owners who are adept at capitalizing on immediate investment opportunities.

Short-Term Financial Relief

For entrepreneurs whose income might be substantial but irregular, the interest-only mortgage provides a financial breathing space. This arrangement can help manage personal and business finances without the pressure of high mortgage payments in the initial years.

Risks and Long-Term Considerations

However, interest-only mortgages carry notable risks. The most daunting is the large balloon payment due at the end of the interest-only period—a lump sum that borrowers must be prepared to handle. There's also the risk of negative equity, where the property value may fall below the outstanding mortgage balance, particularly if the market experiences a downturn.

Planning is essential to avoid these pitfalls, and borrowers must have a robust strategy to accumulate the necessary funds over time.

The Balloon Payment Risk

The primary risk with interest-only loans comes at the end of the interest period when the entire principal amount becomes due. This can be a significant financial burden if not planned for adequately.

Potential for Negative Equity

If property values decrease, borrowers may find themselves in a situation where they owe more on their mortgage than their property is worth, making it difficult to refinance or sell without incurring losses.

Strategies for Managing Lump Sum Payment

It is crucial for borrowers to have a plan in place to accumulate the necessary funds to cover the balloon payment. This could include setting aside monthly amounts in a high-interest savings account, making investments that can be liquidated, or planning to refinance the property.

Comparison with Repayment Mortgages

Understanding the differences between interest-only and standard repayment mortgages is crucial for any entrepreneur or business owner considering property investment.

Each mortgage type has its unique characteristics, benefits, and considerations, influencing your financial strategy in distinct ways.

Key Differences Between Interest-Only and Standard Repayment Mortgages

The main distinction between an interest-only and a standard repayment mortgage lies in the payment structure. With an interest-only mortgage, your monthly payments for the initial period cover just the interest, not touching the principal balance.

This arrangement can significantly reduce your initial financial outlay, providing flexibility that can be crucial during the early stages of property investment or business expansion.

Conversely, a standard repayment mortgage blends payments towards both the interest and the principal from the start, ensuring that every payment brings you closer to full ownership of your property.

"As you pay down the principal, you build equity, secure in the knowledge that with each payment, you're a step closer to owning your asset outright," as many financial experts would advise.

Why Might Borrowers Choose One Over the Other?

Why might a savvy entrepreneur opt for an interest-only mortgage? Perhaps because they expect a significant increase in income in the foreseeable future or have a business model that benefits from greater cash flow flexibility.

Interest-only mortgages can offer breathing room to those who plan to reinvest their capital into high-return ventures, effectively leveraging their assets.

On the other hand, why might someone lean towards a standard repayment mortgage? Stability and predictability often come to mind. For those who value a clear, steady path to reducing debt and increasing equity, the standard repayment plan provides a sense of financial security and gradual progress.

"There's a comforting predictability in knowing exactly how much you owe and how long it will take to pay it off," a sentiment echoed by many homeowners.

Long-Term Financial Impact of Both Options

Consider the long-term implications: can you confidently manage a significant balloon payment at the end of your interest-only period, or would the gradual reduction of debt suit your financial landscape better?

Interest-only mortgages might offer lower initial payments, but they require meticulous financial planning and discipline to prepare for the future lump sum payment. This strategy involves a higher degree of risk and relies on favourable future financial conditions.

In contrast, repayment mortgages might ask more of your budget upfront, but they diminish financial risks over time. Gradually increasing your home equity provides not just peace of mind but also financial flexibility, allowing you to tap into funds for other personal or business opportunities as your property's equity grows.

Isn't it worth considering how these options align with your financial goals and risk tolerance? At The Lending Channel, we understand that these decisions are not just transactional—they're deeply personal. Our commitment is to guide you through these choices with empathy and expertise, ensuring that the path you choose not only meets your immediate financial needs but also supports your long-term aspirations.

Long-Term Planning for Interest-Only Borrowers

To avoid financial strain when the interest-only period ends, borrowers must plan effectively. One strategy is to set aside savings each month into a dedicated account earmarked for the eventual lump sum payment.

Alternatively, borrowers could invest those funds into stocks, bonds, or other growth assets—though this comes with additional risk.

Another approach is to make overpayments whenever possible. If a borrower experiences a particularly profitable year, they might choose to reduce their outstanding principal by making lump sum contributions. This not only lowers the eventual balloon payment but also reduces the overall interest paid throughout the mortgage.

Finally, borrowers should explore their options for refinancing or transitioning to a repayment mortgage before the interest-only period ends. Doing so can smooth out the repayment process, avoid sudden financial shocks, and provide a more structured way to pay off the debt.

Considering an Interest-Only Mortgage? Let’s Plan Together

Interest-only mortgages can be a powerful tool for managing cash flow, especially for entrepreneurs and business owners looking to allocate resources to growth and investment opportunities.

However, they come with considerable risks that require careful planning and financial discipline. The lower monthly payments can provide much-needed flexibility, but the responsibility of repaying the principal remains a key consideration.

Before deciding on an interest-only mortgage, it is essential for borrowers to assess their financial situation realistically and consult with a mortgage advisor who can help tailor solutions to fit their unique needs.

If you are considering an interest-only mortgage, The Lending Channel is here to offer personalised advice and support to ensure your financial decisions align with your long-term goals.

Ready to explore your options? Contact our team today to discuss how an interest-only mortgage might work for you.

.jpg)

.png)